|

Getting your Trinity Audio player ready...

|

Tensions Rise as Ceasefire Agreement Quickly Broken

Ukrainian President Volodymyr Zelensky and former U.S. President Donald Trump engaged in a lengthy phone conversation on Wednesday, discussing Russia’s agreement to an “energy and infrastructure ceasefire.” However, the temporary truce was swiftly violated, reigniting tensions in the region.

Trump confirmed that the conversation with Zelensky lasted about an hour, stating on his Truth Social platform: “Much of the conversation focused on my recent call with President Putin to reconcile Russia and Ukraine on their demands and needs. We are on a very good path.”

Zelensky echoed optimism regarding the discussion, describing it as “positive.” He noted that both Ukrainian and American teams have been directed to clarify technical issues regarding the ceasefire’s implementation and extension. Delegations from both nations are set to meet in Saudi Arabia in the coming days to coordinate further peace efforts.

Ceasefire Agreement Immediately Violated

This marked the first direct contact between Trump and Zelensky since the White House scandal that led to a temporary halt in U.S. military aid to Ukraine. Their renewed dialogue came at a critical moment, as the ceasefire Trump brokered with Russian President Vladimir Putin was violated almost immediately.

On Tuesday evening, Russia launched drone strikes targeting Ukraine’s energy infrastructure, prompting Ukraine to retaliate by bombing a Russian oil depot, which resulted in a massive fire. The Russian Defense Ministry quickly accused Ukraine of provoking the situation, with Kremlin spokesman Dmitry Peskov claiming: “Moscow remains committed to the agreement, but Kiev has not followed through.”

U.S. Defends Russia’s Intentions

In response to the escalating tensions, Trump dispatched his special envoy, Steve Witkoff, to mitigate the situation. Speaking to Bloomberg, Witkoff asserted that the Russian attacks had occurred before Putin issued a ceasefire order and that the Kremlin had given assurances of its commitment to the truce. He emphasized that within ten minutes of Trump’s phone call, Putin had instructed the Russian military to halt attacks, even bringing down seven drones.

“Putin has good intentions,” Witkoff stated, attempting to reassure skeptics.

However, journalists on the ground quickly challenged these claims. British correspondent Oliver Carroll, currently in Ukraine, dismissed the U.S. narrative as “complete nonsense.” He noted that Russian drone strikes continued for hours after the Trump-Putin call, contradicting Witkoff’s statements.

Zelensky Calls for U.S. Oversight of Ceasefire

Prior to the call with Trump, Zelensky had suggested a 30-day mutual ceasefire targeting energy infrastructure but insisted on U.S. monitoring to ensure compliance. He stressed that merely relying on Putin’s assurances was insufficient.

“If the Russians stop attacking our facilities, we will certainly refrain from targeting theirs,” Zelensky affirmed during a press conference in Helsinki alongside Finnish President Alexander Stubb. “However, after more than three years of war, oversight is necessary. The United States should act as the primary enforcer.”

As the international community watches closely, questions remain over whether the ceasefire will hold or if geopolitical tensions will escalate further, despite diplomatic efforts by Trump, Zelensky, and Putin.

- The Guardiola Blueprint: Manchester City’s Relentless, Costly Pursuit of Perfectionby Daniel Alison

In the rarefied air of the Etihad Stadium, success is not merely measured in trophies—though there are plenty—but in microns of tactical margin, in the seamless execution of an idea. When Manchester City secures a signing, like the reported £65 million capture of Bournemouth’s Antoine Semenyo, the football world reacts with a now-familiar mixture of awe and exasperation. The transfer is another data point in the most expensive scientific experiment the sport has ever seen: the relentless, iterative pursuit of footballing perfection under Pep Guardiola.

For the rivals and the skeptics, the narrative writes itself. It is a story of endless chequebooks and cold disposal. Sign Nathan Aké for £45 million. Didn’t work? Go and spend £50 million on Khusanov, £31 million on Ait-Nouri. Give me João Cancelo for £60 million. Didn’t work? Drop £77 million on Josko Gvardiol.

The list, as fans on social media tirelessly chronicle, reads like a chronicle of excess: £100 million for Jack Grealish, £55 million for Jérémy Doku, £34 million for Savio, a rumored pursuit of Rayan Cherki. In midfield, the search for the elusive formula continues: £42 million for Kalvin Phillips, £53 million for Matheus Nunes, £25 million for Mateo Kovačić, and now, whispers of another £60 million for Fiorentina’s Nico González.

Manchester City last match against Manchester united

It is easy, from the outside, to view this as mere financial gluttony. A cynical cycle of buying, discarding, and buying again, funded by a bottomless well of sovereign wealth. The punchline is always ready: Here’s £80 million for Omar Marmoush, he’s a bum. Take another £65 million for Semenyo.

But to dismiss it as such is to miss the profound, almost philosophical heart of the Manchester City project. This is not scattergun spending. This is targeted, iterative problem-solving on a grand scale. Each “failed” signing is not a mistake to be mourned, but a hypothesis tested. Each successive purchase is a refined variable, a closer approximation of Guardiola’s ever-evolving vision.

The Catalan manager does not buy players; he acquires specialist tools for a specific, complex craft. If one chisel doesn’t hold its edge for the precise cut he needs, he finds another, regardless of cost. The mission—to execute his footballing ideal—is paramount. The financial outlay is merely the resource required to eliminate compromise.

For every Grealish who evolves into a crucial controller, there is a Cancelo whose brilliant individualism ultimately clashes with the system’s demands. The system is non-negotiable. The player, no matter the fee, is adaptable or expendable. It is a brutal calculus, but one executed with chilling efficiency.

This approach demands a particular kind of resilience from a player. It can be a cold environment, lacking the sentimental patience of a traditional club. Yet, for a certain breed of footballer, it represents the ultimate challenge: the chance to work under the game’s most demanding architect, to be a cog in the most finely tuned machine in football history. This, reportedly, is what attracted Semenyo—the chance to be forged by Pep.

New signing to Etihad The emotional cost of this model is the erosion of a romantic, patient narrative. There are no long-suffering heroes here, only temporary engineers of success. But the professional yield is unprecedented: a machine that learns, adapts, and improves with every transaction.

So, when the next £65 million signing is unveiled, remember: you are not just watching a transfer. You are witnessing the latest iteration of a blueprint. A draft revised, a formula tweaked, another step in a costly, heartless, and utterly relentless journey toward a perfect game. The rest of football can only look on, criticize the expense, and wonder if they’re even playing the same sport. - Bold Visions Meet Economic Reality in Davos 2026.by Daniel Alison

The 2026 World Economic Forum Annual Meeting in Davos, Switzerland, concluded against a backdrop of rising geopolitical tensions, rapid technological change, and renewed economic nationalism under the newly re-elected U.S. President Donald Trump.

Business leaders, policymakers, and innovators gathered to confront the defining questions of the moment: how artificial intelligence will reshape work, how trade wars may redraw global supply chains, and whether governments can balance growth with stability in an era of disruption.

Drawing from coverage by Yahoo Finance, here are the key takeaways shaping markets, boardrooms, and policy debates worldwide.

Elon Musk’s Davos speak

Global Economy: Tariffs, Deficits, and the Future of the Fed

Economic policy dominated much of the Davos conversation, with U.S. leadership setting the tone.

President Trump outlined an aggressive domestic agenda centered on tariffs, energy expansion, and housing affordability. He argued that “homes are built for people, not corporations,” and floated a controversial proposal to cap credit card interest rates at 10% for one year — a move sharply criticized by JPMorgan Chase CEO Jamie Dimon, who warned it could trigger unintended economic consequences.

Trump also hinted at a near-term announcement for a new Federal Reserve chair, with Jerome Powell’s term set to expire in May. The signal alone stirred speculation about future monetary policy, inflation control, and market volatility.

The cybersecurity treat

Dimon, a frequent focal point at Davos, expressed fatigue over repeated questions about Trump’s agenda, bluntly remarking, “What the hell else do you want me to say?” Still, he acknowledged that tariffs remain a strategic “pressure point” on China, even as concerns grow over ballooning U.S. deficits.

Former Federal Reserve Vice Chair Lael Brainard offered a more structural warning, noting that AI-driven productivity gains risk concentrating growth at the top while leaving much of the broader economy stagnant.

Dimon added a sobering forecast of his own: JPMorgan is likely to employ fewer people within five years due to AI adoption — a stark reminder of looming workforce disruptions.

Technology Takes Center Stage: AI, Automation, and Robotics

If there was one dominant theme at Davos 2026, it was artificial intelligence.

Nvidia CEO Jensen Huang dismissed fears of an AI bubble, calling current infrastructure spending “sensible” and describing AI development as a “five-layer cake” — complex, foundational, and still in its early stages. In a discussion with BlackRock CEO Larry Fink, Huang argued that AI will ultimately create more jobs than it eliminates, though not without painful transitions.

Elon Musk once again delivered some of the summit’s most headline-grabbing moments. The Tesla and SpaceX CEO predicted that humanoid robots will reach the consumer market by the end of next year, eventually becoming as common as smartphones. He also projected widespread adoption of Tesla’s Robotaxi services in the U.S. before 2027, alongside rapid progress toward full self-driving vehicles.

Other tech leaders offered more measured optimism. Affirm CEO Max Levchin argued that AI will fundamentally transform retail without replacing major players like Walmart. Reddit co-founder Alexis Ohanian highlighted AI’s potential to democratize access to knowledge, particularly in education and agriculture.

President Trump, however, injected skepticism into the AI frenzy, openly questioning Meta’s reported $50 billion investment in AI data centers: “How do you spend $50 billion?” he asked, echoing concerns among investors about capital efficiency and returns.

Liverpool Crisis

Geopolitics: Trade, Security, and Strategic Alliances

Geopolitical tensions ran beneath nearly every discussion.

Trump reignited controversy by reiterating U.S. interest in acquiring Greenland — not for rare earth minerals, he claimed, but for “international security.” He warned that NATO allies unwilling to support such moves could face tariffs, linking economic pressure directly to defense commitments.

U.S.–China relations also loomed large. While tariffs remain a central tool of U.S. policy, leaders acknowledged the growing difficulty of full economic decoupling. Dimon emphasized the complexity of maintaining competition without triggering systemic instability in global markets.

Energy, Sustainability, and the Bigger Picture

While sustainability was not the headline focus of Davos 2026, it surfaced indirectly through energy discussions. The prevailing tone favored an “all-of-the-above” strategy, emphasizing expanded domestic energy production as a hedge against geopolitical risk and supply shocks.

The absence of a strong climate narrative itself spoke volumes, reflecting a broader shift toward economic security and industrial resilience over long-term environmental commitments.https://youtube.com/@danchimatv?si=kz-5cZX3-FNYZOLq

What Davos 2026 Signals for Markets and Investors

Davos 2026 delivered a clear message: the world is entering a high-volatility era defined by policy uncertainty, technological acceleration, and geopolitical recalibration.

Artificial intelligence is widely seen as the next major growth engine — but one that may deepen inequality and displace workers before benefits are broadly shared. At the same time, aggressive trade policies and potential shifts in U.S. monetary leadership could inject fresh turbulence into global markets.

For investors, executives, and policymakers alike, Davos reinforced a central truth of the moment: in an age of disruption, the intersection of government power and technological influence will define the financial landscape ahead.

- The United Nations’ Double Standard and America’s Global Bullying Problemby Daniel Alison

For decades, the United Nations has presented itself as the moral compass of the international system—a neutral arbiter committed to peace, sovereignty, and the rule of law. Yet in practice, its conduct exposes a troubling double standard, one that consistently shields powerful states while disciplining weaker ones. Nowhere is this hypocrisy more evident than in the unchecked bullying posture of the United States on the global stage.

The UN is swift to condemn elections, internal politics, or security measures in developing nations. Sanctions are imposed, leaders are delegitimized, and sovereignty is questioned—often based on vague accusations or politicized reports. But when the United States engages in military interventions, economic warfare, covert destabilization, or violations of international law, the UN suddenly becomes cautious, procedural, and silent.

This is not coincidence. It is design.

The structure of the United Nations—particularly the Security Council veto—ensures that powerful states, especially the United States and its allies, remain effectively untouchable. International law is not applied universally; it is selectively enforced. Justice is not blind; it is strategic.

The United States has normalized a culture of intimidation in international relations. Through unilateral sanctions that cripple civilian populations, military bases encircling sovereign nations, and regime-change operations disguised as “democracy promotion,” Washington operates less like a partner in global governance and more like a global enforcer answerable to no one.

When nations resist this pressure, they are labeled “rogue states,” “authoritarian regimes,” or “threats to democracy.” Their leaders are demonized. Their economies are strangled. Their people are made to suffer—not as collateral damage, but as leverage.

And the United Nations? It issues statements.

This passivity is not neutrality. It is complicity.

By failing to confront U.S. aggression with the same urgency applied to weaker states, the UN has undermined its own credibility. It has become an institution that manages power imbalances rather than corrects them—one that legitimizes coercion through silence and normalizes abuse through selective outrage.

The consequences are profound. Smaller nations learn that international law will not protect them. Sovereignty becomes conditional. Multilateralism becomes a myth. And the UN, rather than serving as a shield for humanity, becomes a stage where power performs legitimacy.

If the United Nations is unwilling or unable to hold the United States to the same standards it imposes on others, then it cannot claim moral authority. An institution that excuses bullying while punishing resistance is not a guardian of peace—it is an accessory to domination.

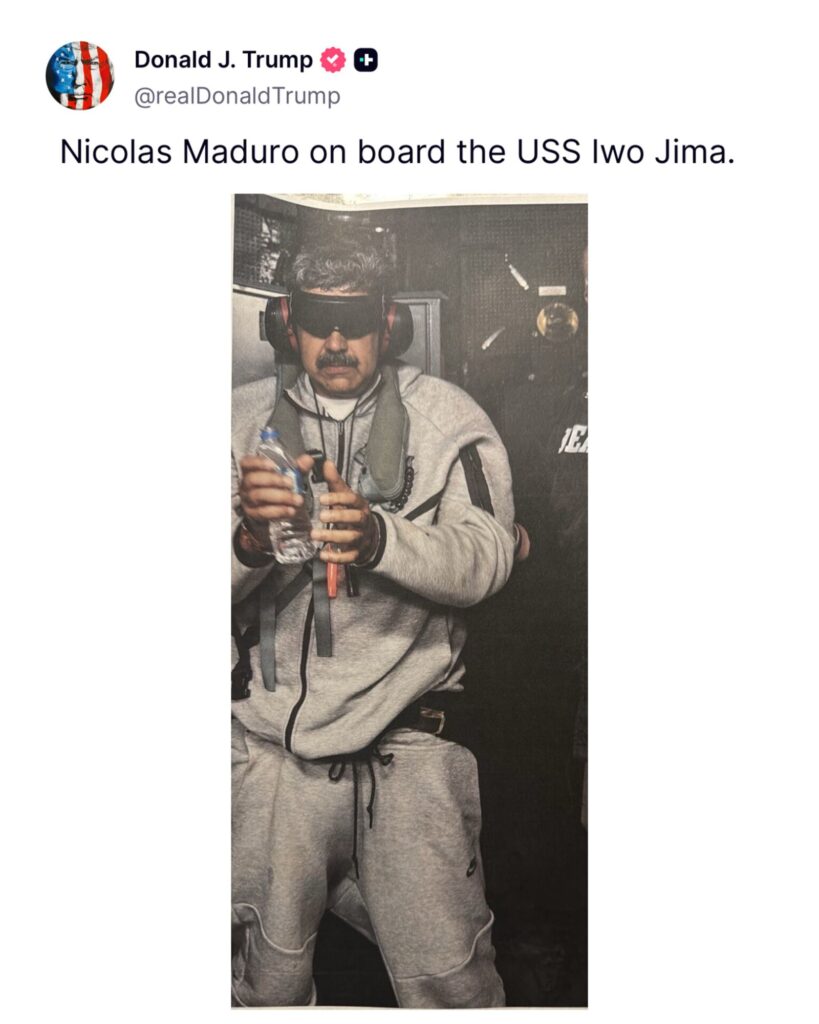

Sanders post

The world does not need a rules-based order where only the weak must obey the rules. It needs genuine accountability, equal sovereignty, and an international system that restrains power rather than worships it.

Until that transformation occurs, calls for reform will ring hollow, and the United Nations will continue its slow descent from global conscience to ceremonial spectator—watching injustice unfold, one double standard at a time.

- FOREIGN AIRSTRIKES WILL NOT SOLVE NIGERIA’S INSECURITYby Daniel Alison

The Federal Government’s acknowledgement of intelligence cooperation with the United States—particularly around possible airstrikes against terrorist groups—should concern every Nigerian who understands the true nature of the country’s insecurity crisis.

Nigeria’s security problem is not religious.

It is a governance failure.

For years, armed groups have ravaged communities, displaced millions, and steadily weakened national unity. Throughout this period, intelligence reports, investigative journalism, and public allegations have repeatedly pointed to influential individuals—both within and outside government—who allegedly sponsor, finance, arm, or facilitate terrorism, often through cross-border networks from the Sahel. Yet the Nigerian state has consistently failed, or refused, to arrest, prosecute, and secure convictions against these powerful actors.

That failure lies at the heart of Nigeria’s insecurity.

Rather than enforce the law against those at the top, the government has chosen the path of least resistance: disarming ordinary citizens, restricting lawful self-defence, and leaving vulnerable communities exposed to violent attacks. A state that denies its people the right to protect themselves, while shielding alleged sponsors of terror, has effectively abandoned its constitutional duty.

It is against this backdrop that foreign military involvement is now being presented as a solution. It is not.

Nigeria does not need the United States, Israel, or any foreign power to secure its territory. History clearly shows that external military intervention rarely cures internal governance failures. Afghanistan was “secured” and later handed back to the Taliban. Iraq was “liberated” and left deeply fractured. Libya was “saved” through foreign intervention; Muammar Gaddafi was killed, and the state collapsed into chaos. Syria today is controlled by actors once labelled terrorists, now selectively legitimised by foreign interests.

These are not success stories. They are cautionary tales.

It is therefore misleading—and dangerous—to frame foreign involvement as an effort to protect Christians or to wage war against Islam in Nigeria. Leaders such as Donald Trump and Benjamin Netanyahu presided over unresolved conflicts and serious human rights concerns within their own spheres. They cannot credibly present themselves as guardians of Nigerian lives.

Even more troubling is the risk that foreign intervention will recast Nigeria’s crisis as a religious war. Nigeria’s insecurity is not Christianity versus Islam. It is impunity versus justice. It is elite protection versus accountability.

If Nigeria allows this crisis to be reframed along religious lines, the consequences will be devastating. Such a conflict will not be confined to forests and remote areas. It will engulf cities, towns, villages, and homes—tearing the country apart in ways that may be impossible to reverse.

Nigeria does not need foreign bombs.

Nigeria needs effective law enforcement.

Nigeria needs arrests, prosecutions, and convictions of terror sponsors—no matter how highly placed they may be.

Above all, Nigeria needs a government willing to apply the law without fear or favour.

Until justice is enforced, no intelligence sharing, no airstrike, and no foreign partnership will deliver peace.

Security without justice is nothing more than an illusion.

US airstrikes missed target, missiles hit empty field – Ex-FRCN DG Salihu

Ladan Salihu, former Director-General of the Federal Radio Corporation of Nigeria, FRCN, has criticized the United States, US, airstrike carried out on Christmas night in Jabo village, Sokoto State, saying it failed to hit its target and was not accurate. On December 25, the US carried out several airstrikes aimed at ISIS fighters in Sokoto, located in north-west Nigeria.

The US Africa Command, AFRICOM, later explained on X that the operation was carried out with the collaboration of the Nigerian government.

AFRICOM said the attack showed the strength of the US military and its determination to stop terrorist threats both within the US and in other countries.

However, Salihu shared a different account in a post on X, saying he personally spoke with Bashar Isah Jabo, a member of the Sokoto State House of Assembly, who visited the affected area shortly after the strike.

According to the lawmaker, the missiles fell on an open field about 300 meters away from a local hospital. No one was injured or killed in the incident.

Salihu added that Jabo village had not experienced any terrorist activity or ISWAP presence throughout 2025. He said there were also no records of farmer-herder conflicts in the area.

He explained that villagers only found missile fragments near a large crater, with no damage to homes or loss of life.

Salihu questioned the purpose of the strike and wondered if it was meant to make headlines rather than eliminate real threats.

While supporting cooperation to fight terrorism, he said attacks should focus on known terrorist leaders and strongholds.

He called on Nigeria’s Defence Headquarters to investigate the incident and provide a clear report to the public.

Salihu also expressed relief that the missiles did not hit the hospital or harm innocent residents of Jabo village.

“I just spoke with Hon Sarkin Yaki Jabo Member Sokoto State Assembly who visited Jabo after the strike at 10:30pm last night. The US strike in Jabo near Tambuwal wasn’t a precision strike. No casualties. Missiles landed in a plain field 300metres away from a Local Hospital,” he said.

- Cutting Corners on Crypto Security: A Costly Lessonby Daniel Alison

In a stark reminder of the risks in the cryptocurrency world, an investor recently lost 4.35 BTC—worth over half a million dollars—after purchasing a hardware wallet from an unverified seller.

According to reports, the device had been tampered with before purchase. The seed phrase, which serves as the master key to a crypto wallet, was pre-set and known to the scammer. Once the buyer transferred funds into the wallet, the attacker immediately swept them away.

The incident highlights a dangerous but common mistake: trying to save a small amount of money by buying security devices from unofficial sources. While the buyer may have saved a few hundred dollars on the purchase, the decision ultimately cost them a fortune.

Security experts warn that cryptocurrency hardware wallets should only be purchased directly from the manufacturer or authorized resellers to ensure their integrity. Any compromise in the supply chain opens the door to pre-installed vulnerabilities, making it trivial for scammers to drain funds.

In the crypto space, trust and security are everything. One wrong move—or one shady purchase—can wipe out years of savings in seconds. - Liverpool Searching for Clear Skies After Seven Months of Turmoilby Daniel Alison

When Virgil van Dijk lifted the Premier League trophy at Anfield on a cool May afternoon, it felt like the perfect conclusion to a season defined by control, confidence, and calm authority. Liverpool’s march to a 20th league title had been impressive not because of relentless drama, but because of how smoothly obstacles were handled. Problems arose, but they were solved with composure. The title was secured with barely a strain.

The celebrations after a 1–1 draw with Crystal Palace on the final day matched the mood. Players danced on the pitch, supporters filled the stands with joy, and there was no sense that Liverpool had reached a peak they could not sustain. Confidence was high. The future looked bright.

That optimism vanished almost immediately.

Within 24 hours, Liverpool’s world tilted. What followed has been one of the most extraordinary and painful seven-month stretches in the club’s long history — a period marked by tragedy, chaos, emotional exhaustion, and sporting collapse.

It began with what should have been a historic triumph: a trophy parade through the city on Monday, 26 May. Thousands lined the 10-mile route, braving heavy rain to celebrate their champions. Van Dijk stood atop the open-top bus, trophy in hand, sunglasses on, music blaring — a scene of pure joy.

Then came horror.

A car drove into the crowd, injuring more than 130 people, from a six-month-old baby to a 77-year-old woman. The moment forever scarred what should have been a day of celebration. Earlier this month, Paul Doyle, a 54-year-old father of three, was sentenced to more than 21 years in prison. While that verdict offers some closure, the emotional wounds will never fully heal.

As the city was still processing that trauma, another devastating blow followed. In July, Liverpool forward Diogo Jota died suddenly. The loss of a beloved teammate, friend, and professional is impossible to measure. Its impact continues to ripple through the squad.

Andy Robertson’s words months later captured the depth of that grief. Speaking after Scotland secured World Cup qualification, the defender admitted he had struggled to cope. Jota had been a constant presence in his thoughts — a teammate with whom he had often spoken about sharing the World Cup stage. The grief, Robertson revealed, had not faded.

It still hasn’t.

That emotional weight has bled into Liverpool’s performances, which have been alarmingly poor. A side once defined by control and resilience has unraveled. Nine defeats in 12 matches told a brutal story, culminating in a disastrous run where 10 goals were conceded across three games due to collective panic and individual errors.

It was Liverpool’s worst sequence since the 1953–54 season.

This collapse is all the more shocking given the scale of the club’s ambition. Over the summer, Liverpool shattered the British transfer record by signing Alexander Isak for £125 million, pushing total spending beyond £440 million. Florian Wirtz, Hugo Ekitiké, and other high-profile additions suggested a dynasty in the making.

Instead, everything has gone wrong.

Isak is now sidelined for months with a fractured leg. Giovanni Leoni’s season ended almost before it began due to a serious knee injury on his debut. Mohamed Salah is away on Africa Cup of Nations duty and may never play for the club again following his revealing post-match interview at Leeds. Discipline issues have surfaced too, including Ekitiké being sent off for a needless shirt-removal celebration.

Champions of England Chaos has become routine.

Yet amid the storm, calls for patience remain. Football writer and lifelong Liverpool supporter Andrew Beasley argues that Arne Slot deserves time. With so much investment in a new squad, replacing the head coach now would only deepen the instability. Proven, serial title-winning managers are rare. Slot must be given space to shape what he has inherited.

That argument holds weight, even if Slot himself has made questionable decisions. His tactics, selections, and squad management have at times contributed to the problems. But he has also shown empathy, dignity, and leadership during moments no coach should ever have to face. From the parade tragedy to Jota’s death, Slot has carried responsibilities far beyond football.

As the festive period passes and the new year approaches, what Slot — and Liverpool — crave most is something simple: calm.

A home fixture against Wolves offers that possibility. With just two points from 17 games, Wolves are on track for a historically poor Premier League season. On paper, this should be straightforward.

But for Liverpool, nothing has been straightforward since that joyful spring day now fading into memory.

The storm has been long. The hope at Anfield is that clearer skies finally lie ahead.

- Jake Paul’s Reality Check: What Anthony Joshua’s Fists Mean for Boxing Fans in Nigeriaby Daniel Alison

Jake Paul’s much-talked-about fight with Anthony Joshua ended the way many African boxing fans predicted — with a harsh lesson in real heavyweight boxing.

The American influencer-turned-boxer has now undergone surgery after suffering two fractures to his jaw, with doctors fitting titanium plates following his stoppage defeat to Joshua in Miami. Several teeth were also removed in the process.

For fans across Nigeria and Africa, the outcome felt less like a shock and more like confirmation: boxing at the highest level is not content creation — it is warfare.

Joshua, a former two-time world heavyweight champion with deep roots admired across Africa, dropped Paul repeatedly before the referee ended the contest in the sixth round. Paul could not beat the count, marking the first stoppage loss of his professional career.

Why African Fans Never Bought the Hype

In Nigeria, Ghana, South Africa and beyond, boxing fans have long respected one thing above all else: pedigree.

From Hogan “Kid” Bassey to Samuel Peter and modern champions across the continent, African fight culture understands the cost of stepping into the ring unprepared. Paul’s leap from cruiserweight bouts into the heavyweight elite raised eyebrows long before the first bell rang.

The weight difference.

The experience gap.

The championship mentality.

All of it showed.

While Paul tried to rely on movement and speed, Joshua’s calm pressure and explosive power made the difference — a reminder that heavyweight boxing punishes mistakes instantly.

A Lesson for the New Generation of Fighters

Paul’s broken jaw is already being talked about in Nigerian gyms and viewing centres. The message is simple:

> There are levels to this game.Social media fame can sell tickets, but it cannot replace years of sparring, discipline, and damage absorbed behind closed gym doors.

Still, African audiences also respect courage. Paul stepped into dangerous territory, and that earns him some respect — even in defeat.

What Comes Next for Jake Paul?

Paul has announced he will take time off to heal and return to cruiserweight, where he hopes to chase a world title. That path makes far more sense and could keep his boxing ambitions alive.

A future rematch with Tommy Fury remains possible, and Paul has continued to talk about a mega-fight with Canelo Alvarez — though many fans believe that talk now belongs strictly to promotion, not reality.

Final Word: Joshua Wins More Than a Fight

For Anthony Joshua, this victory was more than just another payday. It was a statement — not just to Paul, but to the wider boxing world watching from Africa to Europe.

In Nigeria especially, Joshua’s win reinforced something deeply familiar:

> Respect the craft. Respect the ring.

Because when the bell rings, boxing stops being entertainment — and starts demanding payment in blood, bone, and humility.

OPINION: Arsenal Are Better Than Before — But Manchester City Are Still Inevitable

Let’s stop pretending.

Every December, the Premier League convinces itself that this might finally be the year Manchester City blink. And every spring, Pep Guardiola reminds everyone why hope is dangerous.

Arsenal are top of the table again. They are organised, mature, and far more resilient than in previous seasons. Yet the same uncomfortable truth hangs over this title race:

Manchester City don’t need to be perfect early — they only need to be close.

And right now, they are.

The Smile That Should Worry Arsenal

Pep Guardiola criticised his team after a 3–0 win, laughed with reporters, joked with players, and looked completely at ease. That combination should set off alarm bells across North London.

When City struggle, Guardiola is tense.

When City are drifting, Guardiola is defensive.

When City are about to explode into a title run, Guardiola is relaxed.We’ve seen this movie too many times.

Arsenal fans remember December leads. Guardiola remembers May trophies.

Arsenal Are Leading — And That’s the Problem

Leading a title race is not the same as controlling one.

Arsenal must win every week knowing City are lurking. City chase knowing Arsenal cannot afford a slip. That psychological imbalance matters more than tactics.

The Gunners now win ugly games — a real improvement. But ugly wins don’t erase the scars of collapses past. Pressure doesn’t disappear just because lessons were learned.

City don’t carry scars. They carry memories of celebrations.

City’s Transition Is a Lie (Sort Of)

Yes, this is a “new” City. Leaders have left. Injuries exist. Youth has replaced authority.

But Guardiola doesn’t rebuild teams — he resets systems. He drains individuality and installs obedience. By February, this squad won’t feel young; it will feel drilled.

That’s when City usually stop conceding.

That’s when the winning runs begin.

That’s when title races end.Warning

Arsenal are good enough to push City again.

But until Arsenal prove they can outlast Guardiola’s calm, City remain the most dangerous team in England — even when they’re second.

Especially when they’re second.

⚔️ ARTETA VS GUARDIOLA: THE STUDENT HAS LEARNED — BUT THE MASTER STILL FINISHES THE JOB

This Premier League title race is not just Arsenal vs Manchester City.

It is Mikel Arteta vs Pep Guardiola — apprentice versus architect.

And while the gap has narrowed, it has not closed.

Philosophy vs Instinct

Arteta is a planner. Everything Arsenal do is intentional — pressing triggers, rest defence, positional discipline. They are meticulously built.

Guardiola, at this stage of his career, is instinctive. He knows when to rotate, when to accelerate, and when to let chaos work in his favour.

Arteta coaches every moment.

Guardiola feels the season.That difference shows most clearly after Christmas.

Pressure Management

Arteta’s Arsenal play like a team trying to prove something.

Guardiola’s City play like a team that already has.

When Arsenal drop points, the reaction is emotional — urgency, tension, noise. When City drop points, the reaction is cold analysis.

One side fears failure.

The other expects correction.That’s not arrogance. That’s experience.

Squad Evolution

Arteta has created leaders — Ødegaard, Rice, Saliba.

Guardiola has replaced leaders with systems that don’t need leaders.City can lose stars and remain dominant because Guardiola’s authority is absolute. Arsenal still depend on certain players to define their emotional rhythm.

In title races, emotional dependence is dangerous.

The Deciding Factor

Arteta is building a dynasty. Guardiola is defending one.

The difference? Dynasties take time. Defending champions take shortcuts — because they already know the route.

Until Arteta wins a Premier League title, Guardiola owns the mental edge.

Verdict

This is the closest Arsenal have been to City in years.

But close does not beat certain.

Arteta may one day surpass his mentor.

This season, Guardiola still holds the key advantage:He knows exactly how this story ends — because he’s written it before.

- Anthony Joshua Stops Jake Paul as YouTuber Suffers Broken Jaw in Miami Showdownby Daniel Alison

Anthony Joshua eventually ended Jake Paul’s brave but outmatched challenge after catching the YouTuber-turned-boxer with a devastating right hand that left him with a double fractured jaw.

The highly anticipated crossover bout took place at the Kaseya Center in Miami, drawing global attention after being streamed to Netflix’s 300 million subscribers. While many expected a quick finish, Paul surprised critics by surviving six rounds against the former two-time heavyweight world champion.

Paul Earns Respect Despite Brutal Defeat

Despite the glaring size, power, and experience gap, Paul’s willingness to step into the ring with an Olympic gold medallist earned widespread praise from boxing figures.

Chris Eubank Jr was among those applauding Paul’s determination, noting that regardless of the outcome, simply sharing the ring with Joshua was something most would never dare to attempt.

Paul later confirmed the severity of his injuries with a trademark social media post, joking: “Double broken jaw. Give me Canelo in 10 days.”

Joshua: “A Win, But Not a Success”

While Joshua claimed the stoppage victory, he was far from satisfied with his performance.

Speaking after the fight, the British heavyweight admitted he expected more from himself and his team, insisting the win should not be overcelebrated.> “It’s a win, but it’s not a success. I needed to do better. I can’t live off this. I’ve got a lot of improvement to make,” Joshua said.

He also revealed he wished he had finished the fight earlier, while still acknowledging Paul’s courage and refusal to quit after being knocked down.

Fight Stats Highlight the Mismatch

CompuBox statistics underlined the difference in class and output:

Joshua threw 146 punches, landing 48

Paul threw 56 punches, landing just 16

Joshua significantly increased pressure in Round 5, scoring two knockdowns

The fight ended after a powerful sixth-round barrage

Paul managed only nine power punches across the entire contest.

Promoters Hail “Historic Moment”

Most Valuable Promotions, co-founded by Paul, described the event as a “historic moment for the sport”, citing its massive global reach and crossover appeal. Viewing figures are expected to be closely scrutinised given Netflix’s involvement.

What’s Next for Both Fighters?

Joshua hinted at a busy 2026 and even floated potential big-name opponents for Paul should he choose to continue boxing, including Gervonta Davis or Ryan Garcia.

Meanwhile, promoter Eddie Hearn suggested Joshua could return to the ring as early as spring, with long-term plans still pointing toward a Tyson Fury mega-fight.Reaction Rolls In

Former world champion Tony Bellew claimed “everyone won” from the spectacle, stressing the importance that Paul avoided permanent injury.

Even US President Donald Trump weighed in, praising Paul’s courage against a much larger and more experienced opponent.

- Markets Cheer previewsby Daniel Alison

Oracle disappointed. Crypto companies are declining along with bitcoin. Premarket overview

↘️ Oracle (ORCL) -11%. One of the largest software developers and a supplier of server equipment delivered a mixed report. The company plans to increase spending on data centers by $15b.

↗️ Planet Labs (PL) +18%. The company is engaged in space imaging of Earth. Planet Labs broke even, while Wall Street expected a loss.

↗️ Gemini Space Station (GEMI) +16%. The cryptocurrency exchange founded by Cameron and Tyler Winklevoss received a license and is entering the prediction markets.

↘️ Strategy (MSTR) -2%, Coinbase (COIN) -2%. Bitcoin once again approached the $90,000 level.

↗️ Synopsys (SNPS) +1%. The report is better than expected, and the forecast for the first quarter also exceeded the consensus.

↘️ Manchester United (MANU) -5%. Revenue was £140.3m, which is below expectations of £141.05m and 2% lower than the result of £143.1m for the same period last year. The club recorded an adjusted loss per share of £1.48, which is significantly worse than break-even forecasts. Commercial revenue fell 1.3%, broadcasting revenue decreased 4.5%, and matchday revenue dropped 1.1% compared with the first quarter of 2025.

↗️ Ciena Corporation (CIEN) +8%. The supplier of networking equipment reported significantly better than expected results thanks to high demand from cloud providers and growing opportunities in AI infrastructure. The annual revenue forecast is better than estimates: $5.7–$6.1b vs $5.3b.

↘️ Oxford Industries (OXM) -17%. The company published lowered forecasts for the fourth quarter and fiscal year 2025.

DANCHIMA MEDIA · Channel with trading ideas

Trump may legalize marijuana. Broadcom will benefit from the OpenAI contract only in 2027. Premarket overview

🚀 Quanex Building Products (NX) +22%. The building products manufacturer exceeded earnings expectations despite difficult macroeconomic conditions.

🚀 Cannabis companies Canopy Growth (CGC) and Tilray (TLRY) rose more than 20%. The Washington Post writes that Donald Trump is considering removing restrictions on marijuana by executive order.

↗️ Lululemon Athletica (LULU) +8%. The athletic apparel retailer announced the departure of CEO Calvin McDonald and raised its annual profit forecast.

↘️ Broadcom (AVGO) -5%. Concerns about weak margins and the absence of immediate revenue from OpenAI overshadowed strong quarterly results. The server-chip maker gave an optimistic forecast for the current quarter, promising that AI-chip revenue will double year over year. The order backlog for them over the next 18 months will total $73b.

Shares initially rose 3% but reversed when CEO Hock Tan said that revenue from chips not related to AI will decline sequentially this quarter due to weak demand. At the same time, Broadcom’s gross-profit margin from the AI segment is lower than from other segments. Tan also does not expect the OpenAI contract to start generating revenue in 2026. The deal will bring the majority of revenue in 2027, 2028, and 2029.

🚀 Mitek Systems (MITK) +22%. The report was significantly above expectations on earnings per share and revenue. The company develops software for identity verification and fraud prevention. Mitek’s solutions are embedded into mobile applications and web browsers.

↗️ Rh (RH) +2%. The luxury furniture retailer reported earnings per share below consensus, but revenue slightly above expectations. The forecast is better than estimates. CEO Gary Friedman said the company is showing industry-leading growth: revenue +9% for the quarter and +18% over two years despite the worst housing market in almost 50 years and the impact of tariffs. - The Peace Deal That Could Break Ukraine.by Daniel Alison

The Ukrainian President Volodymyr Zelensky is under immense pressure regarding a US-proposed 28-point peace plan to end the conflict with Russia, which includes controversial terms like Ukraine potentially ceding territory and renouncing NATO membership. Zelensky expressed that he will not betray his country’s dignity, but acknowledged the “very difficult choice” of risking the loss of the United States as a key partner if Kyiv does not accept the deal. Although the US, through President Trump, has set a loose Thanksgiving deadline for a response and says they only want the “killing to stop,” the Kremlin claims to have received nothing official regarding the plan, which is widely interpreted as favouring Russian terms. Ultimately, Zelensky is attempting to strike a delicate balance by promising to constructively work with the US on the proposal while presenting alternatives to protect Ukraine’s interests.

Ukrainian President Volodymyr Zelenskyy says Kyiv is prepared for “clear and honest work” on a U.S.-drafted peace proposal aimed at ending the ongoing war with Russia. His comments follow a meeting this week with a high-level American delegation that presented a series of draft proposals — including elements reported to have been shaped jointly by Washington and Moscow.

Zelenskyy told Ukrainians he expects to speak directly with U.S. President Donald Trump in the coming days about the plan, while firmly restating that Ukraine’s sovereignty and territorial integrity remain non-negotiable.

📄 The 28-Point Peace Plan: What’s in It?

Reports suggest the U.S.–Russia proposal includes highly controversial terms:

- Ukraine ceding parts of the Donbas region

- Major cuts to Ukraine’s armed forces, from 900,000 to roughly 600,000

- A ban on NATO troops inside Ukraine

- Security arrangements that critics say leave Kyiv exposed

Zelenskyy did not publicly confirm specific items but made clear that any peace must “respect independence, sovereignty, and the dignity of the Ukrainian people.”

🇺🇸 U.S. Pressure Builds as Trump Seeks Breakthrough

Washington is pushing for visible progress and wants Ukraine to engage openly. Trump, fresh from negotiating a Middle East ceasefire, is reportedly eager to secure another major diplomatic victory.

Zelenskyy has struck a cautious tone:

“We are fully aware that America’s strength and America’s support can truly bring peace closer — and we do not want to lose that.”

Despite U.S. urgency, the Kremlin says it has received no official proposal, though it claims to remain “open to talks.”

🇪🇺 Europe Wants a Seat at the Table

EU foreign policy chief Kaja Kallas warned that Europe must be included in peace negotiations.

“In this war, there is one aggressor and one victim. We haven’t heard of any concessions from Russia.”

European officials fear any U.S.–Russia deal without EU oversight could compromise European security in the long term.

⚠️ Analysts Issue Sharp Warnings

Experts say the draft deal, as described in media reports, would undermine Ukraine’s future ability to defend itself.

Guntram Wolff (Bruegel Institute) said the plan:

- “Would leave Ukraine totally vulnerable to a renewed Russian attack.”

- Reducing Ukraine’s military size and preventing troop deployments “makes no strategic sense.”

Michael O’Hanlon (Brookings Institution) was even more critical:

“Giving up land voluntarily, after Russia seized 19% of Ukraine since 2014, is completely illegitimate.”

He added that the most dangerous part of the proposal is not the territorial concession — but restricting Ukraine’s right to build its own defense.

🧭 What Comes Next?

Negotiations will continue in Kyiv between Ukrainian officials and U.S. representatives. Zelenskyy maintains Ukraine will not make “sharp statements” and will approach talks constructively — but only within Ukraine’s principles:

- Sovereignty

- Safety of Ukrainians

- A just peace

- No forced territorial surrender

The coming days — and Zelenskyy’s call with Trump — may shape the next phase of the war.

- A Planet Under Pressure – Floods, Fires, and the Rising Toll of Climate Extremesby Daniel Alison

In recent weeks, three distant corners of the world—Indonesia, Hong Kong, and Sri Lanka—have been thrust into global headlines for the same tragic reason: disasters that claimed hundreds of lives in a matter of hours. While each event has its own unique causes and local complexities, together they paint a sobering portrait of how vulnerable our societies have become to climate shocks, urban overcrowding, and fragile infrastructure.

Indonesia: Floodwaters Claim Over 440 Lives

Indonesia is no stranger to seasonal monsoon rains, but this year’s downpours have been devastating. Authorities now report that the death toll from widespread flooding has surged past 442 people, making it one of the deadliest weather-related disasters the country has seen in recent decades.

Entire villages were swallowed by rapidly rising waters as rivers overflowed and drainage systems buckled under record rainfall. Rescue teams continue to search for survivors and retrieve bodies from areas still inaccessible due to landslides and collapsed roads. For many affected communities, the floods did more than destroy homes—they wiped out crops, schools, and livelihoods, leaving tens of thousands displaced.

Officials say the combination of intense rain, deforestation, and rapid urban expansion has turned routine monsoons into catastrophic events, reinforcing long-standing warnings from climate scientists that Indonesia remains dangerously exposed.

Hong Kong: Fire Tragedy Leaves 146 Dead

Across the South China Sea, Hong Kong has been mourning after a massive residential fire claimed the lives of 146 people, marking one of the region’s most lethal urban disasters in recent memory.

Thousands of residents have gathered at memorial sites to pay their respects as investigators piece together what sparked the inferno. Many early reports point to issues linked to dense housing conditions—narrow corridors, aging electrical systems, and limited emergency exits in older high-rise buildings.

The tragedy has reignited public debate about safety regulations in one of the most overcrowded cities in the world, where rising living costs have pushed many families into cramped and unsafe accommodations. While the government has pledged a comprehensive review of building codes, critics argue that decades of underinvestment and lax enforcement played a deadly role in the scale of the loss.

Sri Lanka: Deadly Floods Leave Nearly 200 Dead, More Missing

Meanwhile, Sri Lanka is battling its own natural disaster. Torrential rainfall triggered severe flooding and mudslides that have killed at least 193 people, with many more still missing. Homes were swept away as rivers broke their banks, and entire districts remain submerged days after the initial storm.

Emergency responders say the full scale of the disaster may not be known for weeks. Thousands have been forced into temporary shelters, while others await news of relatives trapped in remote, flooded regions. Local meteorological agencies described the rainfall as “unprecedented,” fueling concerns about how climate volatility is reshaping weather patterns across South Asia.

In a nation already grappling with economic strain, the humanitarian and financial toll of the flooding is expected to be enormous.

A Global Pattern We Can No Longer Ignore

Taken together, these tragedies highlight themes that no editorial can overlook:

1. Climate change is amplifying disasters

Floods that once occurred once a decade are now striking multiple times in a single season. Rainfall records are being broken year after year. For developing and developed nations alike, the message is the same: the climate crisis is accelerating.

2. Urban vulnerability is increasing

From Hong Kong’s densely packed apartments to Jakarta’s sinking neighborhoods, population growth and strained infrastructure are turning natural hazards into mass-casualty events.

3. Preparedness is falling behind the pace of risk

Governments worldwide are struggling to upgrade emergency systems, enforce safety regulations, and strengthen disaster response strategies fast enough to match the rising frequency of extreme events.

A Moment for Global Reflection

The loss of nearly 800 lives across Indonesia, Hong Kong, and Sri Lanka is not just a collection of isolated tragedies. It’s a reminder that the world’s most urgent challenges are no longer confined by borders. Floodwaters, fires, and extreme storms are now part of a shared global struggle—one demanding collective action, technological innovation, and above all, political will.

As families mourn across three nations, the world is left with a question:

How many more alarms must ring before we act decisively?

- The era of wild Bitcoin price swings is coming to an endby Daniel Alison

Blockware’s Bitcoin analyst Mitchell Askew says the era of wild Bitcoin price swings is coming to an end. According to him, the market will no longer see the rapid parabolic rallies or the brutal bear-market collapses that once defined crypto cycles. The growing dominance of Bitcoin exchange-traded funds (ETFs), he argues, is steadily reducing volatility and reshaping how the asset behaves.

Askew noted on Friday that Bitcoin now acts like “two completely different assets” when comparing price behavior before and after the launch of U.S. Bitcoin ETFs in January 2024. His chart highlights a pronounced drop in volatility following their debut. He writes:> “The days of parabolic bull runs and devastating bear markets are behind us. Over the next decade, Bitcoin will work its way toward the $1 million mark through repeated cycles of short-term pumps followed by long consolidation phases. This pattern will wear people out and push out short-term speculators.”

Bloomberg’s senior ETF analyst Eric Balchunas agrees that Bitcoin’s reduced volatility has made it more appealing to major, institutional-level investors — giving it a realistic chance of being treated as a legitimate currency. The trade-off? According to Balchunas, the market should no longer expect the dramatic “God candles” that once defined Bitcoin price action.

The rise of ETFs also means more capital is moving into traditional investment vehicles, where holdings cannot be redeemed as physical BTC. As a result, a significant amount of Bitcoin remains locked off-chain. Analysts warn that this institutional investment structure could delay or even suppress the altcoin season that traders typically expect during crypto upcycles.

By July, net inflows into Bitcoin ETFs surpassed $50 billion, yet this massive capital wave did not translate into increased network activity on the blockchain itself. Many retail investors appear to be choosing ETF exposure instead of holding real Bitcoin, allowing fund managers to control the underlying asset on their behalf.

This demand for “paper Bitcoin” — especially products like BlackRock’s ETF — has enabled large asset managers to accumulate sizeable portions of the BTC supply. BlackRock alone now controls about 3% of all existing Bitcoin, raising concerns about growing centralization in what was designed to be a decentralized system.

Taken together, analysts say the Bitcoin of the past decade is gone. Those who continue to rely on old strategies — such as waiting for extreme crashes or betting that Bitcoin will eventually collapse to zero — may need to rethink their approach. As ETFs increasingly stabilize the market, Bitcoin’s volatility is slowly drifting toward levels more commonly associated with gold.

- Trump’s Tariffs, Bitcoin Dump, and Strange SEC Activity — What’s Happening?by Daniel Alison

On August 1, the market woke up to a cold shower: Donald Trump announced the start of new tariffs — and that was enough to trigger a sharp decline.

Here’s a deeper look at what happened below 👇

— Trump announced the first package of trade tariffs. The news broke during the Asian session when liquidity is minimal.

— Bitcoin instantly pierced the $115,000 level.

— In 12 hours, $600 million was liquidated, of which $540 million was from long positions.

Adding to this is the fatigue in the stock market and a general decrease in risk appetite — creating perfect conditions for a cascade of liquidations.

🔥 The SEC seemed to choose the perfect moment for a show:

1️⃣ The application for the first ETF on a meme token — Canary PENGU — has been confirmed.

2️⃣ MicroStrategy is applying to issue bonds worth $4.2 billion for new BTC purchases.

3️⃣ The Project Crypto initiative has been launched: the goal is to adapt infrastructure for blockchain.

4️⃣ Guidance is being updated on defining crypto-assets as securities.

If all this sounds like “something big is coming” — you’re not mistaken.

— The dump was technical: low liquidity + an emotional headline.

— The SEC and major players are not running away — on the contrary, they are making applications and creating infrastructure.

❗️ While the crowd plays the guessing game of “bottom or not bottom” — major players are already paving the way for the next cycle.

Of course, you can nervously refresh the chart after every Trump tweet.

Or you can calmly work with probabilities, build positions where others lose focus — and be in the market when the real movement begins. 😉 - What to Do With Your Money After the New Budgetby Daniel Alison

The latest UK Budget delivered by Chancellor Rachel Reeves has set the stage for significant financial shifts in the years ahead. From frozen tax thresholds to changes in ISA limits and pension rules, millions will feel the impact.

While many of the reforms won’t take effect immediately, now is the time for households to rethink how they save, invest, and plan. Danchima Media breaks down the key changes and expert advice on how to safeguard your finances.1. Protecting Your Savings

The Chancellor announced a major adjustment to cash ISA limits, reducing the current £20,000 allowance to £12,000 for most savers from April 2027. Only adults over 65 will retain the full £20,000 limit.

The Government hopes this will encourage younger savers to push money into stocks and shares ISAs, boosting long-term investment in the economy. But not everyone is keen on market risk, and many prefer the stability of easy-access or fixed-rate savings accounts.

Use Your ISA Allowance While You Can

Financial specialist Anna Bowes advises savers to maximise their current ISA allowances before the cut takes effect.> “Use the full allowance in the next two years before the change kicks in on 6 April 2027. Also review your existing ISAs—switch if your rate is no longer competitive.”

With banks engaged in a “mini price war”, switching has become even more worthwhile.

Consider Fixed Rates and Tax Wrappers

Locking into a fixed-rate savings product now could also be beneficial if future rates fall.

Camilla Esmund from interactive investor reminds savers that ISAs and pensions shield investments from tax and help money grow faster over time.

2. Protecting Your Pension

By 2027, millions of pensioners will pay income tax on their state pension for the first time, due to the continued freeze of the £12,570 tax threshold.

The Budget also targeted salary sacrifice schemes—a popular tax-efficient way to boost pension pots.

New NI Charges on Salary Sacrifice From 2029

From April 2029, salary sacrifice pension contributions above £2,000 per year will attract National Insurance charges. This change may slow down retirement savings for many workers.

Antonia Medlicott of Investing Insiders warns:

> “The new cap may prevent some people from reaching their pension goals. A SIPP gives more control and still offers generous tax relief.”

A £100 contribution, for instance, becomes £125 instantly for basic-rate taxpayers. Growth within a SIPP remains tax-free, and from age 55 (57 from 2028), 25% can be withdrawn without tax.

Maximise Existing Opportunities Now

PensionBee’s Lisa Picardo encourages anyone using salary sacrifice to increase contributions before April 2029 while the rules still favour larger tax-efficient deposits.3. Protecting Your Mortgage and Property Investments

The Budget introduced a £2,500 council tax surcharge on homes valued above £2 million, rising to £7,500 for properties over £5 million—a move widely referred to as a “mansion tax”.

Landlords were also hit with a 2% rise in property income tax, raising their tax bands to:

22% (basic rate)

42% (higher rate)

47% (additional rate)

Combined with pressures from the Renters’ Reform Bill, this could push more landlords to sell, tightening rental supply and driving up rents.

Could Mortgage Rates Rise?

Cash ISAs are a major funding source for banks. Cutting the cash ISA limit could reduce the flow of deposits that lenders rely on, potentially nudging mortgage rates higher.

David Hollingworth, L&C Mortgages, explains:

> “If cash savings tighten, lenders may need to make mortgages more expensive.”

Lock In a Mortgage Early

Experts recommend securing a mortgage rate now—most lenders allow customers to lock in up to six months in advance and still switch if a better deal comes along.

Some rates remain below 4%, although mainly for buyers with strong deposits.

Mortgage adviser Jack Tutton expects continued stability:

> “Rates have been falling for a while, and with no major surprises in the Budget, this trend should carry on.”

4. First-Time Buyers: What You Should Know

Changes may eventually be made to Lifetime ISAs (LISAs), but for now the scheme remains intact. LISAs continue to be a cornerstone for helping young people save towards property.

However, potential reforms could create uncertainty for future first-time buyers.The UK Budget introduces sweeping changes that will reshape how people save, invest, and plan for retirement. While many reforms are delayed, proactive steps taken now—maximising ISA allowances, reviewing pensions, or locking in a mortgage—could shield your finances from future shocks.

Danchima Media will continue to monitor policy shifts and provide reliable financial guidance as the landscape evolves.

- Trump to Meet Putin “Over Next Two Weeks”by Daniel Alison

United States President Donald Trump announced on Thursday that he is expected to meet with Russian President Vladimir Putin “probably within the next two weeks” in Budapest, Hungary.

Speaking to reporters at the White House, Trump confirmed that preparations for the summit are underway. The meeting is part of a renewed diplomatic push aimed at stabilizing relations between Washington and Moscow, and potentially addressing the ongoing Ukraine conflict.🕊️ Diplomatic Engagements Underway

Trump also revealed that US Secretary of State Marco Rubio will soon meet with Russian Foreign Minister Sergey Lavrov — a preliminary step ahead of the presidential summit.

He emphasized that it is “necessary” to hold separate meetings with both Putin and Ukrainian President Volodymyr Zelensky, explaining that the two “don’t get along too well.”Hope for Peace in Ukraine

Despite current tensions, Trump expressed optimism about achieving a diplomatic breakthrough, suggesting that “the long-standing conflict in Ukraine” could be resolved in the near future.

- Pep Guardiola Slams Man City Squad Players After 2–0 Champions League Defeat to Bayer Leverkusenby Daniel Alison

Pep Guardiola delivered one of his most critical assessments of the season after watching a heavily rotated Manchester City side fall 2–0 to Bayer Leverkusen in the Champions League.

Guardiola made 10 changes for the midweek clash at the Etihad, but the players brought in failed to impress. The City boss accused them of playing too cautiously and lacking the bravery required at this level.

“They didn’t try” – Guardiola

Speaking after the match, Guardiola said the defeat wasn’t about squad quality, but mentality.> “They played to avoid mistakes — not to make something happen. In football you have to try. Losing is part of the game, but not trying is the worst thing.”

He added that while results like this can happen, the performance was unacceptable.

https://music.youtube.com/watch?v=k2Gxz4v45j0&si=Wh-_aXChQxSZHMoahttps://youtu.be/N19FyHkiXQs?si=ZFz03MyT0d57hJYkDanchima Music

Bernardo Silva Questions Squad Rotation

Even senior players appeared surprised by the scale of rotation, with Bernardo Silva publicly questioning the decision to make so many changes for such an important fixture.

Guardiola, however, defended his selection, saying rotation is unavoidable due to the schedule — though he admitted the match was a “lesson” for him.

Guardiola: “Maybe I’m too nice”

Sky Sports’ Ben Ransom reported a rare light-hearted moment in Guardiola’s press conference. When asked whether he would now be “less nice” after giving fringe players a chance, Guardiola joked that he would remain the “beautiful person” his parents raised.

But make no mistake: the manager is laser-focused on correcting City’s form. After back-to-back defeats to Newcastle and Leverkusen, he is expected to restore his strongest XI for Saturday’s Premier League clash with Leeds.

Rodri Still Out for Leeds Clash

Guardiola confirmed that key midfielder Rodri remains sidelined with a hamstring injury, extending an absence that began in October.

Despite falling seven points behind league leaders Arsenal, Guardiola refused to engage in title-race talk:> “The distance is there, yes. Arsenal are very strong. But I focus on the next game — Leeds — and then we’ll see.”

City Look to Reset Against Leeds

The priority now is simple: avoid losing further ground in the Premier League. With Leeds visiting the Etihad on Saturday at 3pm, City are under pressure to respond quickly and convincingly.

- Guardiola ‘Embarrassed and Ashamed’ After Confrontation With Cameraman Following Man City Defeatby Daniel Alison

Manchester City manager Pep Guardiola has publicly apologised after a heated post-match confrontation with a cameraman during City’s 2–1 defeat to Newcastle United at St James’ Park on Saturday.

The Premier League champions were left furious by a series of contentious decisions — including a disputed penalty claim, an unawarded handball, and a tight offside call — which contributed to a frustrating afternoon for Guardiola’s side.

‘I Feel Embarrassed’ — Guardiola Admits He Crossed the Line

Footage showed Guardiola marching onto the pitch at full-time to question referee Sam Barrott before pulling the headphones off a cameraman to speak directly into his ear. The clip drew widespread criticism online.

Guardiola later expressed regret:> “I apologised. I feel embarrassed, ashamed when I see it. I don’t like it. I apologised after one second to the cameraman. I am who I am. After 1,000 games I’m not a perfect person — I make huge mistakes. I want to defend my team and my club.”

The tense scenes didn’t stop there. City goalkeeper Gianluigi Donnarumma was ushered down the tunnel, while Newcastle midfielder Joelinton had to be held back by manager Eddie Howe. Guardiola also exchanged heated words with Newcastle captain Bruno Guimarães, though he insists they maintain a good relationship.

City Turn Focus to Champions League Test

Despite domestic frustrations, Manchester City now shift their attention to Tuesday’s Champions League clash against Bayer Leverkusen, where they look to preserve their unbeaten run in the group stage.

The match will mark Guardiola’s 100th Champions League game as Manchester City manager — a tenure highlighted by the club’s historic 2023 triumph in Istanbul.

City currently sit fourth in the group’s table under the competition’s new format. A win would strengthen their position in the top eight and secure a direct path into the knockout rounds.

> “Every season we’ve been there,” Guardiola said. “To challenge the best in Europe is incredible. There are more disappointments than good moments, but that’s football.”

‘Worst Season of My Career’ — Gvardiol Reflects on 2024/25

Defender Joško Gvardiol, reflecting on last season’s trophyless campaign, admitted the struggles took a toll:“It was the worst season I ever had in my career. I couldn’t sleep because I was trying to find solutions to help the team. But I’m glad it’s behind us.”

City were knocked out in the Champions League play-offs, finished third in the Premier League, and lost the FA Cup final to Crystal Palace — their most difficult season in nearly a decade.

Fans comments on this matter

Fan Reactions: Debate Over Manager Conduct

The incident has reignited discussions about behaviour in elite football, especially towards match officials and staff. Many fans argue Guardiola should face sanctions, while others insist the emotional intensity of the sport explains such outbursts.

Some supporters called for community service-style punishments — requiring managers to volunteer in grassroots football — instead of fines that have little impact on top-level figures.

Others highlighted the contrast in media treatment between Guardiola and other managers, with claims that officials hesitate to penalise the Manchester City boss.

What Happens Next?

The Football Association and Premier League are expected to review footage of the confrontation. As of now, no disciplinary action has been announced.

Manchester City will be hoping the controversy doesn’t distract from their crucial Champions League fixture as they aim to rebuild momentum after a turbulent week.

- London Calling: The Perfect Christmas Shopping Escape From Grazby Daniel Alison

Just in time for the festive season, Graz residents now have an easier way to experience London’s Christmas magic. Since 21 November, British Airways has introduced a convenient direct connection between Graz and London Gatwick, available three times a week — ideal for a quick shopping trip or weekend getaway.

London remains one of the world’s most dynamic and stylish cities, especially during the holidays. Its iconic shopping districts, like Oxford Street and Regent Street, transform into glittering boulevards filled with lights, displays, and holiday music. Department stores and boutiques offer everything from luxury gifts to unique handmade finds.

For those seeking festive atmosphere, London’s Christmas markets provide a world of options. The famous Winter Wonderland in Hyde Park is the city’s largest holiday attraction, offering food stalls, rides, a grand ice rink, and a lively market scene.

Covent Garden brings together premium shopping and seasonal décor, while the Southbank Centre Winter Market stretches along the Thames, offering scenic views and artisan goods. Food enthusiasts will appreciate Borough Market, beautifully decorated and filled with culinary delights from around the world.

With London now just a short flight away, Graz travelers have the perfect excuse to soak in the holiday atmosphere — and take care of their Christmas shopping in one unforgettable trip.Covent Garden brings together premium shopping and seasonal décor, while the Southbank Centre Winter Market stretches along the Thames, offering scenic views and artisan goods. Food enthusiasts will appreciate Borough Market, beautifully decorated and filled with culinary delights from around the world.

With London now just a short flight away, Graz travelers have the perfect excuse to soak in the holiday atmosphere — and take care of their Christmas shopping in one unforgettable trip.

- Arsenal Injury Update: Latest on Gabriel, Gyokeres and Calafiori Ahead of North London Derbyby Daniel Alison

Arsenal have been hit with several new injury concerns just days before their crucial north London derby against Tottenham at the Emirates Stadium. Mikel Arteta is awaiting updates on the fitness of Gabriel Magalhães, Riccardo Calafiori, and Viktor Gyokeres, adding uncertainty to an already intense fixture week.

The Gunners enter this period at the top of the Premier League, but potential defensive absences could pose a major challenge—especially with Bayern Munich and Chelsea also on the schedule in the coming weeks.

Here is the latest on each player and their expected return dates.

Gabriel Magalhães

Gabriel suffered a worrying setback while playing for Brazil, limping off during a friendly win over Senegal at the Emirates Stadium. He required treatment for a right-thigh issue before being substituted.

Brazilian officials confirmed that imaging tests revealed a muscle injury in his right thigh, initially reported as an adductor concern. Gabriel has now returned to London for further assessment, and Arteta is expected to provide more clarity during his pre-match press conference on Friday.

Potential return: Unknown

Amara A latest songs

Riccardo Calafiori

Calafiori’s situation surfaced just hours before Gabriel’s injury, as the defender withdrew from Italy duty due to a hip problem. Despite being named in the squad, he was unable to train fully, and Italy manager Gennaro Gattuso confirmed the player could not risk worsening the issue.

Reports from Italy suggest Arsenal do not fear a serious injury, and optimism remains that he could recover in time for the derby.

Potential return: November 23, 2025 vs Tottenham (H)

Viktor Gyokeres

The striker has been sidelined since picking up a hamstring injury against Burnley on November 1. Gyokeres missed subsequent matches and was left out of the Sweden squad during the international break as Arsenal continue to monitor his progress.

With decisive matches looming, his recovery remains a priority for the medical team.

Potential return: Unknown

Kai Havertz

Havertz is close to a comeback after almost three months out following knee surgery. He has not featured since the opening weekend of the season but is now nearing full fitness. Arteta recently described his return as a “huge boost” for the squad.

Potential return: November 23, 2025 vs Tottenham (H)

Martin Ødegaard

Arsenal’s captain remains sidelined with a knee injury that initially kept him out of Norway duty. After weeks of shoulder issues earlier in the season, Ødegaard is still not ready for action.

Norway boss Ståle Solbakken has said Ødegaard is still “some distance away,” though the midfielder insists progress is being made.

Potential return: Unknown

Noni Madueke

Madueke has been missing for nearly two months after picking up a knee injury against Manchester City. Thankfully, scans ruled out ACL damage, and he is among the players Arsenal hope to have available after the break.

Potential return: November 23, 2025 vs Tottenham (H)

Gabriel Martinelli

The winger has been out since suffering an injury against Crystal Palace on October 26. Martinelli missed Brazil’s latest fixtures but is expected to be in contention after the international break.

Potential return: November 23, 2025 vs Tottenham (H)

Gabriel Jesus

After nearly a year out with a long-term knee injury, Gabriel Jesus has finally returned to training. The Brazilian forward has been ramping up his recovery and is edging closer to a full return.

Potential return: Late 2025

- Another Warning Sign for Austria’s Industrial Futureby Daniel Alison

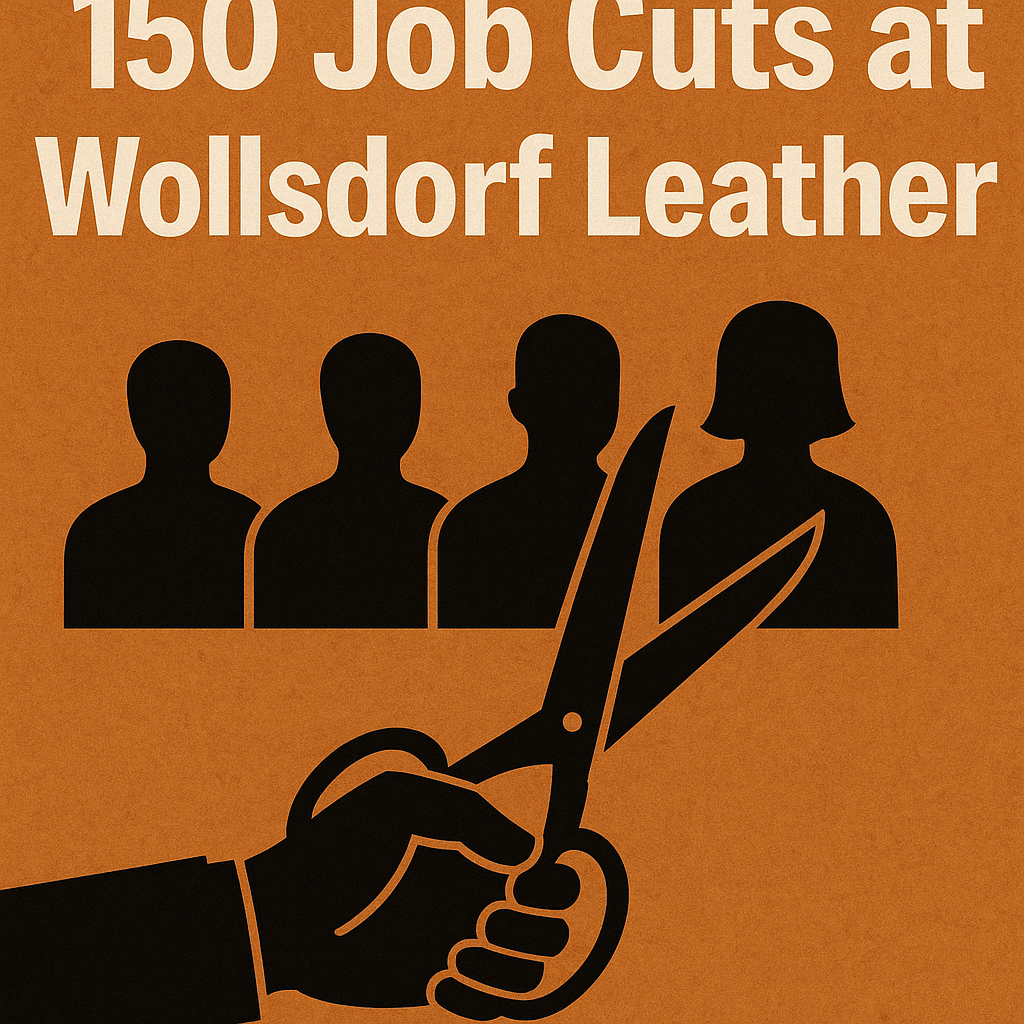

The layoffs at Wollsdorf Leather are more than just another sad headline—they are a symptom of the deeper structural problems Austria has been ignoring for too long. When a well-established company with decades of expertise in high-quality leather production decides it is cheaper to move operations to Mexico, it signals a dangerous shift: our industrial base is becoming unsustainable under current economic conditions.

Of course, globalization and cost competition are nothing new. But what is alarming is how quickly Austrian jobs—especially those held by women—are becoming collateral damage in a race to the bottom. The fact that 150 people, many of them cross-border commuters who depended on stable employment in Weiz, will soon find themselves without work shows how vulnerable the region’s economic model has become.

The automotive sector, one of Austria’s traditional strengths, is under intense pressure worldwide. But instead of finding innovative ways to strengthen local production, companies are increasingly opting for the cheapest possible labor markets. This is understandable from a business perspective, but devastating for communities built around industry.

Worse still, officials openly admit that unemployment is expected to rise further in 2026, with no relief in sight. That is a stark warning: people will be forced to retrain, reskill, and accept jobs far removed from the trades and industries that once defined their professional identity.

The real question is this:

How long can Austria maintain its reputation as a high-quality production hub if manufacturing keeps fleeing to cheaper countries?

If policymakers do not act—by reducing costs, improving competitiveness, and supporting strategic industries—more companies may follow Wollsdorf’s path.

For the workers of Wollsdorf, this is not an economic debate. It is a personal crisis. For the region, it is a wake-up call.

And for Austria, it is another reminder that the industrial landscape is changing faster than public policy can keep up.

- Labour Faces Internal Backlash as Shabana Mahmood Unveils Tougher Asylum Reformsby Daniel Alison

The Labour Government is facing mounting resistance from within its own ranks after Home Secretary Shabana Mahmood unveiled a series of hardline changes to the UK’s asylum system—measures that some backbenchers say mirror the harshest approaches seen in Denmark and the United States.

Mahmood announced the reforms on Monday, arguing that Britain’s asylum framework is “broken” and urgently needs overhaul to stem the surge in small boat crossings across the English Channel.

What the New Reforms Include

The proposed changes introduce:

Potential visa bans on countries refusing to cooperate with deportations

Fast-track removal procedures for failed asylum applicants

A shake-up of how refugee status is granted and renewed

The moves mark a significant shift toward stricter border control—a stance that has already unsettled several Labour MPs.

Backbench Rebellion Begins

At least nine Labour MPs have gone public with their objections.

Nottingham East MP Nadia Whittome condemned the Denmark-inspired policies as “dystopian”, accusing the Government of tearing up protections for traumatised refugees.

She questioned whether the UK would accept being treated the same way if its citizens were fleeing war:

“How can we be adopting such obviously cruel policies? Is the Home Secretary proud that the Government is being praised by Tommy Robinson?”

Another Labour MP warned privately that the reforms could jeopardise the party’s chances in London borough and mayoral elections, calling the strategy “political self-sabotage.”

Mahmood Defends Her Approach

Facing criticism in the Commons, Mahmood said the reforms are necessary to restore public trust:> “Our asylum system is broken. Its failure is creating division across the entire country.”

She also argued that the UK is now seen as an unusually attractive destination for asylum seekers, with many “asylum shopping” across Europe for the most favourable conditions.