How are the USA actually planning to accumulate a BTC reserve of 1 million bitcoins if taxpayer funds are not going to be directed there?

One of the solutions we have already discussed here. It has become known that more than half of the states in the USA (26 out of 50) have introduced bills to reserve bitcoins, proposing to allocate up to 10% of state funds into cryptocurrency.

This means that up to 10% of the state budget will be directed towards the direct purchase of bitcoin. But that’s not all.

The Bitcoin Policy Institute has released a concept according to which the USA could implement the purchase of bitcoins worth $200 billion through special bitcoin bonds.

The BitBonds platform is designed to achieve four key objectives:

1. Significantly reduce the interest burden on treasury bonds, providing immediate relief to the tax and budgetary load;

2. Expand the strategic reserve of bitcoins without additional costs to taxpayers, rapidly increasing bitcoin stocks in our country;

3. Create a savings instrument with tax benefits for American families that ensures both security and growth potential; and

4. Develop an effective path for gradually repaying a significant portion of the federal debt through asset appreciation rather than increasing taxes or cutting spending.

The proposed structure allocates 90% of the bond income to regular government financing operations and 10% to the acquisition of bitcoins.

Thus, there will be no direct taxpayer expenses for purchasing bitcoins, but state funds obtained as income from bitcoin bonds will be spent.

At the very beginning, when Trump announced that taxpayer funds would not be used to create a state reserve in bitcoins, this wording seemed somewhat suspicious.

It was clear that one could not collect a million bitcoins solely through confiscations. The state must somehow participate in financing the purchase of BTC for the sovereign fund if that fund’s task is to eliminate government debt.

And now a way has been found: BitBonds. The most interesting thing in this story is that now the bitcoin market has a new market maker, and that is the richest state in the world – the USA.

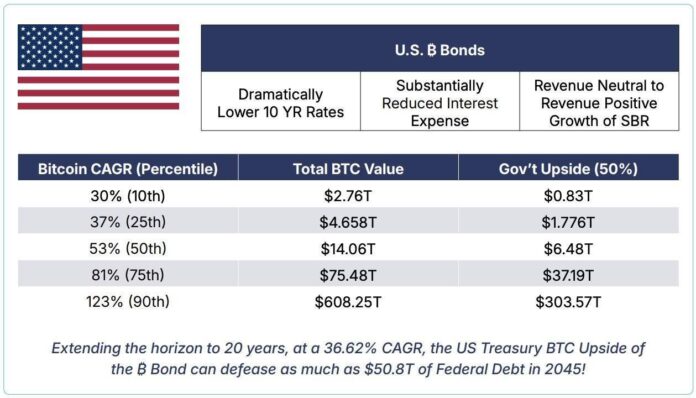

The Bitcoin Policy Institute calculated that the national debt could be settled by 2045, and even published reports on the growth of bitcoin capitalization over a 20-year horizon.

In the last line, we can see the total value of bitcoin at $608 trillion. And this is not fantasy; the planned CAGR (Compound Annual Growth Rate) for bitcoin in the table is a modest 30%.

You can plan your bitcoin investments for 20 years. With a market maker like the US government, success can be expected.