In mid-October 2025, Elon Musk reentered the crypto conversation in force, drawing a stark distinction between Bitcoin and fiat money. With just a few words on X (formerly Twitter), he restated a creed that many in the crypto community already champion: fiat is subject to arbitrary dilution; Bitcoin is anchored by real-world energy.

> “You can issue fake fiat currency, and every government in history has done so, but it is impossible to fake energy.”

— Elon Musk

That statement, short but provocative, sets the stage for a renewed ideological battle between traditional monetary systems and the new paradigm of digital scarcity.

The Core Contrast: Fiat’s Flexibility vs Bitcoin’s Rigidity

To understand Musk’s framing, it helps to recall what separates fiat and Bitcoin at a fundamental level.

Fiat: Elastic, Policy-Driven, Subject to Inflation

Monetary policy control: National central banks can adjust supply via printing money, open market operations, quantitative easing, etc.

Inflation risk: Because supply isn’t strictly capped, fiat currencies run the risk of devaluation through oversupply or “money printing.”

Reliant on institutional credibility: The value of fiat depends heavily on the trust in institutions and the willingness of people to accept it as payment.

Policy weaponization: Governments sometimes monetize deficits or employ inflationary strategies to manage debt, which can undermine currency value over time.

Bitcoin: Fixed Supply, Energy-Backed, Decentralized

Hard cap: Bitcoin’s protocol limits the supply to 21 million coins, preventing arbitrary inflation (barring radical forks or protocol changes).

Proof-of-work / energy-backed: To produce new Bitcoins, miners must expend real energy — compute cycles, electricity, hardware — making creation costly and measurable. Musk and others argue you can’t fake that energy cost.

Decentralization & consensus: No single entity controls Bitcoin issuance or validation; it’s distributed among nodes and miners.

Deflationary potential: Some argue that Bitcoin, over long timeframes, may become deflationary (value goes up) as supply tightens relative to demand.

Musk’s recent engagement centers on this “energy vs printing” framing: fiat can be fabricated, while Bitcoin’s backbone is anchored in something “real” (energy).

What Changed—Why Now?

Why issue this reaffirmation at this moment? A few converging themes suggest the timing is calculated.

1. Rising government spending & AI push

Analysts argue that as nations pour resources into AI races, defense, infrastructure, and technological competition, fiscal burdens may drive further currency issuance. Zerohedge, in a post Musk responded to, argued that valuations of gold, silver and Bitcoin are partly driven by fears of fiat debasement to fund these “AI arms races.”

2. A lull in Musk’s crypto commentary

Musk had largely remained quiet on Bitcoin since late 2022, when he forecasted a prolonged crypto winter after the FTX collapse. His return to strong language signals renewed interest—or a repositioning—in the public debate.

3. Meme & influence economy

Musk’s statements still carry outsized influence. Even a one-word reply (“True”) to a speculative thread triggered waves in media and crypto circles. His reentry into Bitcoin’s narrative may test whether his influence remains potent.

4. Energy / environmental narrative shift

Much criticism of Bitcoin has centered on its environmental footprint. Musk’s invocation of “energy you can’t fake” turns the narrative: energy is not a bug—it’s a feature. In effect, he pivots energy consumption from liability to proof-of-value.

Tensions, Caveats, and Criticism

Musk’s line is rhetorically compelling, but it’s not without controversy or pushback.

The energy critique still looms

Bitcoin mining remains energy-intensive, and skeptics argue that its marginal environmental cost and carbon footprint are unsustainable, especially if reliant on fossil fuels. While miners are increasingly using renewables, the transition is uneven across geographies.

Volatility and use-case limitations

Bitcoin’s volatility makes it less suited for everyday transactional use. For fiat, being a medium of exchange and stable store-of-value over time is essential. Bitcoin’s speculative swings and liquidity demands complicate its adoption as “money.”

Institutional and regulatory friction

governments are unlikely to cede control over monetary policy easily. Many jurisdictions are strengthening regulation, oversight, and potentially seeking to limit or co-opt cryptocurrencies. The transition from niche store-of-value to mainstream money faces strong institutional resistance.

The rhetorical leap: energy = intrinsic value?

One of the more contested points: does consuming energy inherently confer value? Critics say not all energy consumption is productive — energy used inefficiently or wastefully doesn’t guarantee value corresponds. Musk’s framing assumes that the energy cost itself establishes scarcity and legitimacy.

Skeptics within the crypto/intellectual community

Some prominent thinkers have long criticized Bitcoin’s premises. For instance, Nassim Taleb remains staunchly skeptical of Bitcoin’s role as a stable currency due to volatility and incentive misalignments. Others have argued against the narrative that monetary systems can be replaced by code alone, pointing out that Bitcoin’s success depends on social, legal, and trust frameworks beyond purely technical ones.

What This Means for Crypto, Markets & Monetary Thought

Musk drawing such a sharp distinction may have ripple effects across multiple domains.

Narrative reinforcement: His renewed commentary bolsters the ideological framing of Bitcoin-as-digital-hard-money, potentially energizing crypto advocates.

Investor sentiment & flows: Even casual signals from Musk can sway sentiment, especially among retail investors watching for cues.

Policy discourse: As governments debate CBDCs, central bank digital currencies, and stablecoins, the contrast between fiat and Bitcoin becomes thematic, not just technical.

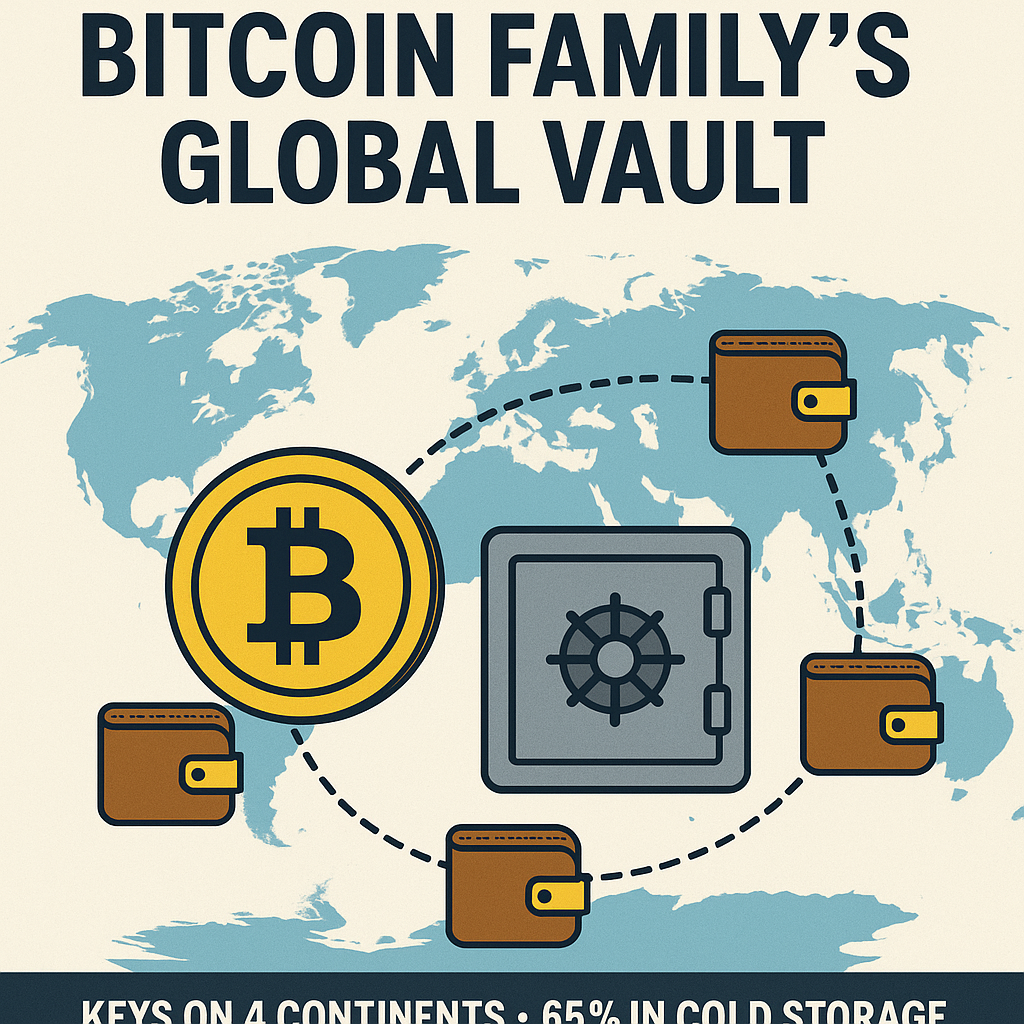

Infrastructure bets: The “energy backbone” framing may lead to more spotlight on mining infrastructure, renewable energy for mining, and synergies between energy markets and crypto.

Academic & monetary debate: The provocation invites reexamination of what gives money value — is it utility, scarcity, institutional trust, energy cost, or some blend?

A Clear Line—But a Long Road

By drawing a clear line between fiat and Bitcoin, Musk is restating a core crypto creed: that value must be anchored in something that opaque institutions cannot arbitrarily manipulate.

Whether that line convinces skeptics or changes monetary architectures is another question. What it does do is re-center debates around scarcity, energy, legitimacy, and trust—and forces both crypto believers and traditional financiers to reckon with the assumptions underlying “what is money.”