|

Getting your Trinity Audio player ready...

|

Ousmane Dembélé has capped off a sensational season with Paris Saint-Germain by being named UEFA Men’s Player of the Season, after inspiring the French giants to a historic 5-0 victory over Inter Milan in the Champions League final in Munich.

The emphatic win not only secured PSG’s first-ever European crown, but also marked the largest winning margin ever recorded in a Champions League final.

It was a season of transformation for the 28-year-old winger. Early disciplinary issues saw Dembélé dropped by coach Luis Enrique for a group stage clash against Arsenal. But a tactical shift—moving Dembélé into a more central attacking role—proved pivotal. He responded by scoring eight goals in the tournament, playing a crucial part in PSG’s dominance.

Though he didn’t find the net in the final, Dembélé delivered two key assists and was widely hailed as the engine of PSG’s attack. His tireless work rate and leadership even earned extraordinary praise from his coach.

“I would give the Ballon d’Or to Mr. Ousmane Dembélé,” Enrique said. “The way he defended tonight—just that alone could be worth the Ballon d’Or. That’s how you lead a team. Goals, trophies, leadership, defence, his pressing.”

Doué Named Young Player of the Season as PSG Floods UEFA Honors

Meanwhile, PSG’s Desire Doué (19) was awarded UEFA Men’s Young Player of the Season, following a breakout campaign that culminated in a phenomenal final performance. Doué assisted the opener for Achraf Hakimi, then went on to score two goals himself, sealing his reputation as one of Europe’s most exciting young talents.

In total, seven PSG players were named in UEFA’s Team of the Season:

- Gianluigi Donnarumma

- Achraf Hakimi

- Marquinhos

- Nuno Mendes

- Vitinha

- Desire Doué

- Ousmane Dembélé

Adding international flavor to the lineup was Arsenal’s Declan Rice, who impressed with four Champions League goals—two of which were stunning free-kicks against Real Madrid in the quarter-finals.

PSG’s Statement Season

PSG’s triumph is more than a milestone—it’s a statement of intent. With a squad balanced by youth and experience, and led by a revitalized Dembélé, the Parisians finally claimed the European prize that had eluded them for so long.

This season’s UEFA awards show not only individual excellence but the collective rise of PSG as Europe’s new elite force.

- Thomas Frank Sacked by Tottenham After Eight Months in Charge

by Daniel Alison

by Daniel AlisonTottenham Hotspur have dismissed head coach Thomas Frank after just eight months in charge, following a home defeat to Newcastle that left the club 16th in the Premier League, only five points above the relegation zone.

Frank, who was appointed on 12 June 2025 on a three-year contract to replace Ange Postecoglou, departs after failing to secure a league victory in 2026. Spurs endured a run of eight league matches without a win, managing only two victories in their last 17 Premier League games. The club also suffered early exits from both domestic cup competitions.

While Tottenham’s Champions League campaign has been relatively positive — finishing fourth in the league phase to reach the last 16 — domestic struggles and fan unrest ultimately sealed Frank’s fate.

Supporter frustration had intensified in recent weeks, with fans openly booing the coach and chanting for his dismissal during home matches. Critics pointed to uninspiring attacking play, limited creativity, predictable crossing patterns, and poor buildup structure. Tottenham’s attacking unit struggled to deliver consistent goal output, with several high-profile forwards contributing only six league goals combined this season.

The club’s poor home form proved particularly damaging, with Spurs winning just two league matches at the Tottenham Hotspur Stadium — a record worse than all but Burnley and Wolves.

Although the Tottenham board initially resisted sacking Frank, citing injury setbacks, squad limitations, and the demands of Champions League football, the mounting pressure from performances, results, and fan sentiment forced a change.

In a statement, the club said it had been committed to giving Frank time to build long-term progress, but concluded that a managerial change was necessary at this stage of the season.Frank becomes the latest managerial casualty in Tottenham’s turbulent recent history.

- Suspect in shooting of senior Russian general has been detained, Russia saysby Daniel Alison

Russia’s Federal Security Service said Sunday that the man suspected of shooting a deputy chief of Russia’s military intelligence agency in Moscow was detained in Dubai and handed over to Russia.

Lt. Gen. Vladimir Alekseyev was hospitalized after being shot several times Friday by an assailant at an apartment building in northwestern Moscow, Investigative Committee spokesperson Svetlana Petrenko said. The attack followed a series of assassinations of senior military officers that Russia has blamed on Ukraine.

The Federal Security Service (FSB) said a Russian citizen, Lyubomir Korba, was detained in Dubai on suspicion of carrying out the shooting. In a statement on its website, FSB said it had also identified two “accomplices,” one of whom was detained in Moscow and another who “left for Ukraine.”

Asked about the shooting, Russian Foreign Minister Sergey Lavrov said Friday it would be up to law enforcement agencies to pursue the investigation but described it as an apparent “terrorist act” by Ukraine intended to derail peace talks.

There was no immediate response from Kyiv to a request for comment on the Russian allegations.

The shooting came a day after Russian, Ukrainian and U.S. negotiators wrapped up two days of talks in Abu Dhabi, the United Arab Emirates, aimed at ending the nearly 4-year-old conflict in Ukraine. The Russian delegation was led by Alekseyev’s boss, military intelligence chief Adm. Igor Kostyukov.

Alekseyev, 64, has served as the first deputy head of Russia’s military intelligence agency, known as the GRU, since 2011.

He was decorated with the Hero of Russia medal for his role in Moscow’s military campaign in Syria. In June 2023, he was shown on state TV speaking to mercenary chief Yevgeny Prigozhin, when his Wagner Group seized the military headquarters in the southern city of Rostov-on-Don during his short-lived mutiny.US President Donald Trump.

Since Moscow sent troops into Ukraine in 2022, Russian authorities have blamed Kyiv for several assassinations of military officers and public figures in Russia. Ukraine has claimed responsibility for some of them.

In December, a car bomb killed Lt. Gen. Fanil Sarvarov, head of the Operational Training Directorate of the Russian Armed Forces’ General Staff.

In April, another senior Russian military officer, Lt. Gen. Yaroslav Moskalik, a deputy head of the main operational department in the General Staff, was killed by a bomb placed in his car parked near his apartment building just outside Moscow.A Russian man who previously lived in Ukraine pleaded guilty to carrying out the attack and said he had been paid by Ukraine’s security services.

Days after Moskalik’s killing, Ukrainian President Volodymyr Zelenskyy said he received a report from the head of Ukraine’s foreign intelligence agency on the “liquidation” of top Russian military figures, adding that “justice inevitably comes” although he didn’t mention Moskalik’s name.

In December 2024, Lt. Gen. Igor Kirillov, the chief of the military’s nuclear, biological and chemical protection forces, was killed by a bomb hidden on an electric scooter outside his apartment building. Kirillov’s assistant also died. Ukraine’s security service claimed responsibility for the attack

- South Korean Crypto Exchange Accidentally Distributes Over $40 Billion in Bitcoin

by Daniel Alison

by Daniel AlisonA major South Korean cryptocurrency exchange, Bithumb, has admitted to mistakenly distributing more than $40 billion (£32 billion) worth of bitcoin to customers — briefly turning hundreds of users into crypto millionaires.

The error occurred when the company intended to issue a small promotional reward of 2,000 won (about $1.37) to users. Instead, due to a technical glitch, it mistakenly credited recipients with 2,000 bitcoins each.

Bithumb said the mistake was detected quickly, and trading and withdrawals for 695 affected accounts were frozen within 35 minutes of the incident. The company claims it has since recovered 99.7% of the approximately 620,000 bitcoins that were incorrectly distributed.

In a statement, the exchange emphasized that the incident was not the result of hacking or a security breach, insisting customer assets and platform security remain intact.> “This matter has nothing to do with external hacking or system vulnerabilities,” Bithumb said.

Regulators Step In

South Korea’s Financial Supervisory Service (FSS) announced it will review the incident following an emergency meeting. Officials warned that any evidence of illegal activity could trigger a formal investigation.

Bithumb’s CEO, Lee Jae-won, pledged full cooperation with regulators and promised stronger safeguards going forward.

> “We will take this incident as a serious lesson and prioritize customer trust and stability over rapid growth,” he said.

Compensation and System Upgrades Planned

To restore confidence, Bithumb announced it will:

Pay 20,000 won ($13.66) in compensation to all active users at the time of the error

Waive trading fees for affected customers

Upgrade its verification systems

Introduce AI-based monitoring tools to detect abnormal transactions in real time

A Broader Industry Wake-Up Call

The incident is expected to intensify global conversations around financial safeguards and crypto regulation, highlighting the risks of automated transaction systems.

A similar case occurred in April 2024, when Citigroup mistakenly credited a customer $81 trillion instead of $280 — an error that was reversed only after multiple employees failed to catch it.

- Starmer ignored warnings from ministers on how to stop Mandelson rebellion

by Daniel Alison

by Daniel Alison

Starmer ignored warnings from ministers on how to stop Mandelson rebellion

Keir Starmer (right) revealed that he knew about Peter Mandelson’s relationship with convicted paedophile Jeffrey Epstein (Photo: Carl Court/PA)

Sir Keir Starmer’s No 10 and Labour whips ignored warnings as early as Tuesday evening that a Labour rebellion was brewing over the release of full vetting documents relating to Peter Mandelson’s appointment as the UK’s ambassador in the US.

Three government sources told The i Paper that it had not been former deputy prime minister Angela Rayner who initially led attempts to secure changes to how the papers would be published.

Instead, they credited behind the scenes lobbying from Cabinet minister Alan Campbell and Home Office minister Jess Phillips with trying to change minds in No 10 and save Starmer from a humiliating climbdown.

Downing Street had endeavoured to temper the Conservatives’ attempt to disclose the Mandelson paper trail by incorporating provisions for national security and the safeguarding of international relations.

However, MPs called the action a “cover-up” and advocated for Parliament’s Intelligence and Security Committee (ISC), rather than the Cabinet Secretary, to decide on their disclosure.

LIVERPOOL, ENGLAND – JANUARY 25: Former Deputy Prime Minister of the Labour party, Angela Rayner, delivers a speech during Labour’s North West Regional Conference at the Titanic Hotel on January 25, 2026 in Liverpool, England. The 2026 regional conference serves as a key gathering for over 60 Labour-held seats in the North West and a significant portion of the party’s membership. Rayner addresses the Labour North West regional conference as a back bench MP after stepping down from her ministerial positions last year over tax irregularities. In her speech she encourages party members to “fight back for the soul of this country” from Nigel Farage and Reform UK at the local elections on May 7. (Photo by Ryan Jenkinson/Getty Images)

While Rayner was widely credited with leading the rebellion, the truth is more nuanced, a party source said (Photo: Ryan Jenkinson/Getty)

At Prime Minister’s Questions (PMQs) at noon on Wednesday, Starmer was still advocating for his plan but after the rebellion threatened to get out of hand, whips were forced to draft a last-minute amendment to appease MPs.

By Wednesday evening, his authority was in tatters.

“No 10 and the whips were warned on Tuesday that the ISC was the only viable option,” one of the Government sources said.

“Jess Phillips and Alan Campbell are the unsung heroes in all this. From Tuesday night, they were saying they had to go down the ISC route,” the second source said.

“Keir was still talking about not using the ISC at PMQs,” the source added. “There’s a constant pattern of this in No 10; arriving at the correct position far too late and then not getting the credit because they fought it all the way there.”

The third source confirmed that Campbell and Phillips had both been in No 10 on Wednesday morning and discussed the depth of unease among Labour backbenchers with Starmer’s officials.

Campbell spoke to Starmer himself. ISC Chairman Kevan Jones had also been consulted and was willing for his committee to come on board.

But even as he took PMQs at noon, Starmer had not heeded their advice. Tory Leader Kemi Badenoch urged Labour MPs to rebel and vote with her to include the ISC in overseeing the documents’ release.

After Starmer revealed that he knew about Mandelson’s relationship with convicted paedophile Jeffrey Epstein, Labour MPs retreated into Parliament’s tearoom in shock and fury.

The message – which had been relayed privately to No 10 – that they would not support the Government’s original motion, was now played out publicly on the floor of the Commons and social media.

While Rayner was widely credited with leading the rebellion, the truth is more nuanced, a party source said. “Maybe she did some tearoom rallying, but the work had been done,” the source said.

Rayner’s intervention was widely interpreted as a reminder that she has leadership intentions of her own, while she seeks to settle her outstanding tax payments with HMRC.

“Angela was in the chamber salivating as she was sticking the knife in, but then she’s always there to kick Keir when he’s down,” a second Labour source said, adding, “But behind the scenes it was Alan and Jess doing the heavy lifting.”

An ally of Rayner rejected the characterisation. In fact, Rayner had stuck to the facts in the chamber.

“Given the public disgust and the sickening behaviour of Peter Mandelson and the importance of transparency, in 2022 I proposed a humble address seeking information about Personal Protective Equipment [PPE] which the [Conservative] party resisted,” she said.

“Should we not have the ISC have the same role in keeping public confidence in the process?”

A spokesman for Rayner and Downing Street declined to comment.

The picture that motivated furious King to force Andrew into isolation

The picture that motivated furious King to force Andrew into isolation

The i Paper

I did a job I loved, but now have no savings – and can’t retire like my friends

I did a job I loved, but now have no savings – and can’t retire like my friends

The i Paper

I’m an Olympic curling champion – my seven tips to become an armchair expert

I’m an Olympic curling champion – my seven tips to become an armchair expert

The i Paper

The UK is abandoning helicopters, tanks … and its ability to defend itself

The UK is abandoning helicopters, tanks … and its ability to defend itself

The i Paper

Peter Mandelson came to my wedding – and then tried to have me sacked

Peter Mandelson came to my wedding – and then tried to have me sacked

Video shows flashpoint over flags in town divided by plan to house 540 migrants

ByJoe Duggan

Feb 5, 2026 7:08 pm CET

Video shows flashpoint over flags in town divided by plan to house 540 migrants

The row over flags displayed in Crowborough, right. Lorna Marter, 37, left, said the flags had been put up by her children (Photos: The i Paper)

Outside an ex-military site in Crowborough, a late morning confrontation laid bare growing tensions in the East Sussex town over asylum seeker accommodation.

A scuffle broke out between a woman who had cut down Union Jack and St George’s flags from fencing outside Crowborough Training Camp and three protesters trying to take them back.

Minutes later, a bus carrying migrants arrived at the former military barracks, which has seen weekly demonstrations since plans to house up to 540 men were revealed in October.

The woman – who asked not to be named – said she was “shaken” by the argument with two men and a woman, but had stopped to take down the flags as she found them “really offensive”.

“I cut the flags down. They’re being used for racist, aggressive purposes, to make these people, these asylum seekers, feel unwelcome,” she told The i Paper.

“The fact this big man is aggressively standing in front of me, raging and then pulling these flags back off me, says it all.

“They all came up to me, and they grabbed them off me. They forcibly took the flags off me and said, ‘these are our property’.”

As she spoke, one of the men was heard asking where she lived and the woman grabbed some flags from her hand.

One of the three protesters, Bob, said they came to the site to get an idea of movements into the camp and saw her “ripping off” the flags with scissors.

“She started telling us that we’re racist and don’t we know what this flag means?” he said.

“I said, ‘It’s the flag of our country. Why is that being racist?’”

When it was put to him that the woman had felt intimidated, he replied: “Why didn’t she just give us the flags back?”

Sussex Police said no criminal offences were identified after officers on patrol responded to an “altercation”.

But the dispute is a microcosm of how the issue of asylum accommodation has divided the country and sparked anger in local communities, with Crowborough the latest flashpoint.

In a recent environmental impact assessment sent to Wealden District Council, Steve Reed, the Housing Secretary, warned of the risk of riots over plans to accommodate asylum seekers at the base, which had been used by Army cadets.

There have been regular peaceful protests in the town, but nothing to suggest any escalation, the council has said.

The statement from the Ministry of Housing, Communities and Local Government on behalf of Reed also said there is no previous evidence to indicate increases in crime from asylum seeker accommodation.

But local residents in Crowborough who spoke to The i Paper say they have safety concerns after the first 27 male asylum seekers were rehoused at the site last month.

Banners and flags draped at the entrance to Crowborough army base Photo: Joe Duggan

Banners and flags draped at the entrance to Crowborough Training Camp (Photo: Joe Duggan)

Last year, disturbances broke out in Epping outside a hotel housing asylum seekers after an Ethiopian resident, Hadush Kebatu, sexually assaulted a 14-year-old girl and a woman eight days after arriving in the UK on a small boat.

“I’m scared for my kids’ safety. I don’t want them to walk around the streets anymore,” said, Lorna Marter, 37.

“I’ve got an 11-year old, a 13-year-old and 15-year-old daughter as well. I just went for a walk down to the other gate on my own, and I felt uncomfortable.”

She held the flags that were cut down earlier that morning, which she said her children had put up on Saturday.

Concerns about the camp have led to residents forming a group called Crowborough Patrol, whose members wear hi-vis jackets and branded red baseball caps as they walk through the town.

Dave Williams, who lives next to the base, said he has installed £5,000 of security around his land, with estate agents saying he and other homeowners can now “forget” about selling.

Dave Williams, who lives next to the base, said he has installed ?5,000 of security around his land, with estate agents saying he and other homeowners can now “forget” about selling. Photo: Joe Duggan

Dave Williams, who lives near the base, has installed £5,000 of security measures around his property (Photo: Joe Duggan)

“Placing 540 unvetted males in a very small town, in a small camp right where there’s a lot of housing right on the edge of town, I think it’s ill-conceived,” he said.

“They can’t justify putting it so close to a town and really allowing them to have freedom of movement when we don’t know who they are, where they come from, what the background is.”

The Home Office says the site has 24/7 security with CCTV and strict sign-in processes for residents who have completed health and police checks before arriving at the base.

Mr Williams said he had attended the protests that have seen hundreds march through Crowborough against the Government proposals.

But not everyone in the town of around 22,000 is supportive of the weekend rallies.

“I’d hate to be a refugee with nowhere to go, so I just hope that they behave themselves and don’t give people cause to say, ‘I told you so’. But otherwise I don’t go marching,” said Alison Atkinson, 73.

I’d hate to be a refugee with nowhere to go, so I just hope that they behave themselves and don’t give people cause to say, ?I told you so?. But otherwise I don’t go marching,? said? Alison Atkinson, 73m in Crowborough.

Alison Atkinson, 73, says she has not attended the marches against using the military site in Crowborough as accommodation for asylum seekers (Photo: Joe Duggan)

“I’m one of the Crowborough litter pickers, and I do more good keeping the town nice than they do marching up and down.

“Decent folk can’t get up and down the road, and an ambulance would never get through. So they’re a little bit of a nuisance.”

Carlos, 65, said he felt “fifty-fifty” about asylum seekers being housed at the camp.

“Obviously, they’re [the protesters] not all from Crowborough. They’re coming from other towns as well,” he said.

“People in private, they’re saying that they feel for the migrants. But then again, they say they feel for their local residents as well.”

But migrants’ rights group Care4Calais said Crowborough is “another disaster waiting to happen” after asylum seekers’ housed at ex-military base Wethersfield in Essex and Napier Barracks in Kent reported the sites were “isolating and retraumatising”.

Hundreds of people assemble, waving flags and banners, outside Crowborough Training Camp, where the Home Office is planning to house 600 male migrants in a former army barracks in East Sussex,

United Kingdom, on January 25, 2026. The first 27 migrants were transported to the camp under police escort at 3:30 a.m. on Wednesday, January 21, 2026. (Photo by STUART BROCK/Anadolu via Getty Images)

A number of protests like this one last month have been held in Crowborough in recent weeks (Photo: Stuart Brock/Anadolu/Getty)

Home Secretary, Shabana Mahmood, has been tasked with speeding up efforts to close asylum hotels to bring down costs, arguing military sites are vital for the plan.

Home Office figures show the number of asylum seekers being temporarily housed in hotels increased by 13 per cent to 36,273 at the end of September.

Mahmood has vowed to defend any legal challenge “vigorously”.

Kim Bailey, chair of residents’ group Crowborough Shield, which has been granted a hearing to determine if there are grounds for a judicial review, said local people fell “betrayed”.

“Because this is a decision that is going to impact on this whole town, this town’s way of life,” she said.

“They have just ram-raided this decision through with no consultation, no risk assessments, no impact assessments, no consideration for the asylum seekers themselves.”

James Partridge, the Liberal Democrat leader of Wealden District Council, which has submitted arguments to the court objecting to the Home Office’s decision ahead of the hearing , said the camp is “not suitable”.

“This council is completely opposed to the Government’s plans to house asylum seekers at Crowborough Camp,” he said.

“It’s time the Government was forced to listen to what local people are saying.”

A Home Office spokesperson said: “The Government is removing the incentives drawing illegal migrants to Britain.

“That is why we will close every single asylum hotel, moving illegal migrants into basic accommodation like military barracks.

“We are also making it easier to remove illegal migrants off British soil, with nearly 50,000 people with no right to be here returned or deported under this Government – an increase of 23 per cent.”

More from

The i Paper

The i Paper

Labour ‘women in grey suits’ could be sent to tell Starmer to resign

Labour ‘women in grey suits’ could be sent to tell Starmer to resign

The i Paper

I’m a dream engineer – I get inside people’s heads like in Inception

I’m a dream engineer – I get inside people’s heads like in Inception

The i Paper

The evidence Jeffrey Epstein was a spy for Putin – examined

The evidence Jeffrey Epstein was a spy for Putin – examined

The i Paper

Delaine Le Bas: ‘My parents weren’t bothered about sending me to school’

Delaine Le Bas: ‘My parents weren’t bothered about sending me to school’

The i Paper

Keir Starmer’s hand tremors are nothing to be ashamed of. You wouldn’t cope

Keir Starmer’s hand tremors are nothing to be ashamed of. You wouldn’t cope - The Epstein Files Expose a Culture of Elite Impunity — Not Just a Criminal Network

by Daniel Alison

by Daniel Alison

The latest release of millions of Epstein-related documents is not merely another scandal cycle — it is a window into how power, privilege, and silence intersect at the highest levels of society.

While appearing in the Epstein files does not equate to criminal guilt, the revelations point to something just as unsettling: a prolonged culture of tolerance toward a convicted sex offender by some of the world’s most influential figures.

This is no longer just a story about Jeffrey Epstein.

It is a story about who stayed close to him, who benefited from proximity, and who chose convenience over conscience.

Elite Access, Moral Blindness

The files reveal casual emails, social exchanges, financial interactions, and invitations involving billionaires, politicians, royalty-linked figures, and media power brokers — long after Epstein’s crimes were publicly known.

Even when wrongdoing is denied, a fundamental question remains unanswered:

Why did Epstein continue to enjoy social legitimacy among global elites after his conviction?

Legal innocence does not erase ethical responsibility.

Turning a blind eye is not neutrality — it is complicity by comfort.

A Failure of Institutions, Not Just Individuals

Beyond the names themselves lies a deeper institutional failure.

Governments delayed transparency.

Agencies filtered disclosures.

Authorities released records reluctantly — and only after public pressure.

This raises a troubling reality:

If accountability depends on outrage, can justice ever truly be trusted?

Partial transparency does not restore confidence — it erodes it. And every withheld document strengthens public suspicion that the full truth remains buried.

The Real Victims Are Still Being Marginalized

As public attention fixates on famous names, the voices that matter most continue to be sidelined: the victims.

Women and girls who endured exploitation remain overshadowed by celebrity intrigue, political spin, and media spectacle. The moral center of this case has repeatedly been displaced — not by accident, but by a culture that prioritizes status over suffering.

Justice for Epstein’s victims should not be an afterthought.

It should be the headline.

The Bigger Reckoning

The Epstein files force an uncomfortable but necessary reckoning:

This is not only about a predator.

It is about how elite networks protect reputations, normalize misconduct, and escape consequences.

The most disturbing revelation is not merely who appears in the documents —

but how routine this proximity to power appears to have been.

If society fails to confront the systems that enabled Epstein, it risks repeating the same cycle — with different names, different victims, and the same silence.

- Bitcoin’s Latest Dip Is Not Fear — It’s a Test of Conviction

by Daniel Alison

by Daniel Alison

Disclaimer: This article reflects personal opinion and market commentary only. It is not financial or investment advice.

Bitcoin has done it again.

After briefly dipping toward the $75,000 level, Bitcoin rebounded near $78,000, triggering a familiar cycle of panic, speculation, and emotional trading across the crypto space. Headlines screamed fear, timelines filled with doom posts, and market sentiment indicators lit up in red.

But this wasn’t a breakdown. It was a stress test.

As Bitcoin pulled back, gold surged—once again playing its traditional role as a perceived safe haven. To critics, the divergence looked like a warning sign. To experienced market participants, it was business as usual. Bitcoin has always moved differently. Volatility isn’t a defect in the system; it’s part of its design.

When fear dominates sentiment, logic often disappears. History shows that extreme fear phases are frequently where long-term positions are quietly built, while short-term traders exit in frustration. Markets don’t punish lack of intelligence—they punish lack of discipline.The boys in the crypto memes For investors in emerging economies, particularly across Africa and the Middle East, Bitcoin is more than a speculative asset. It is a hedge against unstable currencies, policy uncertainty, and restricted financial access. In that context, temporary drawdowns are less alarming and more expected.

This latest dip serves as a reminder: Bitcoin does not reward impatience or emotional decision-making. It rewards conviction, risk awareness, and long-term thinking. Those who survive crypto cycles are rarely the loudest voices—they are the ones who understand what they hold and why they hold it.

The real story is not the dip itself.

It’s the reaction to it.

Volatility is the price of participation.

Conviction is the differentiator.

And Bitcoin continues to separate believers from tourists.

- What We Learned — and Didn’t — From Melania Trump’s New Documentary

by Daniel Alison

by Daniel Alison

A newly released documentary, Melania: 20 Days to History, offers a controlled and carefully curated look into Melania Trump’s life in the days leading up to Donald Trump’s January 2025 inauguration. Co-produced by the former first lady, the film promises intimacy and insight — but delivers more polish than personal revelation.

While the project claims to show Melania’s journey from private citizen to first lady, much of the footage focuses on surface-level moments: travel scenes, event preparations, wardrobe fittings, and design meetings. Viewers hoping for candid reflections on politics, family life, or her husband’s presidency may leave feeling unsatisfied.

Small Personal Glimpses, Limited Depth

The documentary’s most human moments come from brief off-script interactions. Melania reveals her fondness for Michael Jackson, even singing along to “Billie Jean” during a car ride. However, these moments feel fleeting — more like branding than meaningful storytelling.

The film’s most emotional segment centers on her grief over the death of her mother, Amalija Knavs, in 2024. Melania describes the loss as deeply painful, calling her mother “the richest thread of my life.” Her vulnerability here stands out as one of the documentary’s few genuinely revealing scenes.

A Carefully Curated Inner Circle

The documentary highlights Melania’s close relationships with her stylist Hervé Pierre and France’s First Lady Brigitte Macron. Their conversations focus on fashion, aesthetics, and shared personal values. Yet, broader family dynamics — including her relationship with Donald Trump’s children — are largely absent.

Her son Barron appears briefly but avoids the spotlight, reinforcing the film’s theme of privacy over transparency.

The new Melania Trump’s movie

A Reserved First Lady

Throughout the film, Melania hints at discomfort with the public demands of her role. She speaks about balancing responsibilities as a mother, wife, and public figure, emphasizing emotional resilience over political involvement.

Although world events appear in the background — including humanitarian crises and hostage cases — Melania avoids detailed political commentary, choosing empathy without clear policy stances.

Politics, Public Reaction, and Controversy

Public reaction to the film has been heavily shaped by politics. Critics argue the project functions as reputation management, especially given its funding by Amazon and its release during a period of political tension and protests in the US.

Supporters praised the documentary at screenings, while detractors accused it of being tone-deaf, overly expensive, and strategically timed to influence public perception.

What the Film Ultimately Reveals

Rather than offering groundbreaking insight into Melania Trump’s worldview or influence, the documentary reinforces her preference for privacy, control, and distance from political controversy.

Her closing message frames the role of first lady as personal evolution:

> “The real nobility is becoming stronger than the person I was yesterday.”

- Madueke Steps Up as Arsenal Crush Leeds and Strengthen Title Push

by Daniel Alison

by Daniel AlisonArsenal delivered a commanding 4–0 win over Leeds United at Elland Road, reinforcing their Premier League title credentials — and showcasing the squad depth that could define their season.

With Bukayo Saka ruled out moments before kickoff due to injury, many Arsenal fans feared a dip in attacking threat. Instead, Noni Madueke seized the opportunity, proving why the club invested heavily in him.Manchester City The former Chelsea winger was instrumental in Arsenal’s dominance, providing two assists and unlocking a stubborn Leeds defense. His precise cross allowed Martin Zubimendi to open the scoring with a header, before another dangerous delivery led to a Karl Darlow own goal, doubling Arsenal’s lead before halftime.

Despite Leeds showing brief pressure early in the second half, Arsenal’s superior depth proved decisive. Gabriel Martinelli, introduced off the bench, set up Viktor Gyökeres for Arsenal’s third, while Gabriel Jesus sealed the victory late on with a composed finish after a clever assist from Martin Ødegaard.

The match highlighted Arsenal’s evolving identity under Mikel Arteta — a team no longer reliant on just one or two stars, but built on depth, tactical flexibility, and match-changing substitutes. Even with travel disruptions caused by fog forcing a long coach journey north, the Gunners played with control and confidence.

With a seven-point lead at the top of the Premier League table, Arsenal have steadied their title charge, reminding rivals Manchester City and Aston Villa that their squad strength could be the deciding factor in the race.

- US Government Enters Partial Shutdown Despite Late Senate Funding Dealby Daniel Alison

The United States federal government has entered a partial shutdown after a last-minute funding agreement failed to clear all legislative hurdles.

The funding lapse took effect at midnight Eastern Time on Saturday (05:00 GMT), only hours after the US Senate approved a stopgap bill to keep most federal agencies funded through September. Under the agreement, the Department of Homeland Security (DHS) received only two weeks of temporary funding rather than full-term coverage, preventing its immediate closure.

However, the deal has not yet been passed by the House of Representatives, which is currently out of session—triggering the partial shutdown.

President Donald Trump negotiated the compromise with Democrats after they declined to approve additional funding for immigration enforcement agencies. The standoff follows public outrage over the fatal shooting of two US citizens in Minneapolis by federal immigration agents.

This marks the second government shutdown within a year and comes just 11 weeks after the conclusion of the previous impasse, which lasted 43 days—the longest shutdown in US history. That 2025 shutdown, spanning from 1 October to 14 November, disrupted major government services, including air travel, and left hundreds of thousands of federal workers unpaid for weeks.

While the current shutdown is expected to be shorter and less disruptive, the White House has instructed several departments—including transportation, education and defence—to begin implementing shutdown procedures.

In a memo circulated to federal agencies, the White House said employees should report to work only to carry out “orderly shutdown activities,” adding that officials hope the lapse will be brief.

President Trump has urged Republican lawmakers, who hold the majority in the House, to support the Senate-approved deal when they return to session on Monday.

Lawmakers plan to use the two-week DHS funding window to negotiate a broader agreement. Democrats insist that any long-term deal must include reforms to immigration enforcement practices.

“We need to rein in ICE and end the violence,” Senate Minority Leader Chuck Schumer said, calling for stricter oversight of Immigration and Customs Enforcement. He demanded an end to roving patrols, mandatory judicial warrants, visible identification for officers, body cameras, and an end to masked operations. “There should be no secret police,” he added.Criticism of immigration enforcement tactics has intensified following the fatal shooting of Alex Pretti, an intensive care nurse, in Minneapolis last weekend. Pretti was shot by a US Border Patrol agent during an altercation in which multiple agents attempted to restrain him.

In response, the US Justice Department announced on Friday that it has launched a civil rights investigation into the incident.

As political negotiations continue, the shutdown underscores deep divisions in Washington over immigration policy, law enforcement accountability, and federal funding priorities.

UK–China Reset: What Starmer’s China Visit Really Achievedby Daniel AlisonThe recent visit of UK Prime Minister Sir Keir Starmer to China marks the most significant shift in UK–China relations in nearly a decade. After years of strained diplomacy, both nations appear to be signaling a cautious economic and political thaw, driven by internal financial pressures and shifting global power dynamics.

Starmer’s trip—the first by a British prime minister since 2018—highlights a broader effort to revive trade, rebuild trust, and secure new investment channels between London and Beijing.

Why This Visit Matters

Both Britain and China are navigating economic uncertainty at home. For the UK, the mission aimed to open new trade opportunities in sectors such as:

Finance

Pharmaceuticals

Healthcare

Clean energy

Automotive manufacturing

For China, the visit serves as a strategic message to the West that it remains open to cooperation, especially as the United States adopts a more aggressive trade stance under President Donald Trump.

While no comprehensive free trade agreement emerged, the discussions resulted in tangible economic and diplomatic commitments that signal a slow but deliberate reset.

Key Agreements and Economic Gains

AstraZeneca’s Major Investment

AstraZeneca announced a $15 billion investment in China over the next four years to expand pharmaceutical research and manufacturing. This marks the company’s largest-ever financial commitment in the Chinese market.

UK Entry into China’s Energy Market

British energy firm Octopus Energy partnered with PCG Power to launch a digital electricity trading platform in China. The project is designed to improve power efficiency and support China’s renewable energy expansion, giving the UK a foothold in the world’s largest green energy market.

Scotch Whisky Tariff Reduction

China agreed to cut import tariffs on Scotch whisky by half, a move expected to inject approximately £250 million into the UK economy over five years. The deal strengthens Scotland’s global whisky competitiveness in a rapidly expanding Chinese consumer market.

Visa-Free Travel for British Citizens

British travelers can now visit China visa-free for up to 30 days, improving tourism, business travel, and cultural exchange. The UK joins a list of countries already benefiting from similar access.

Migration & Security Cooperation

Both governments committed to increased collaboration on combating human trafficking and migrant-smuggling networks, aligning with UK domestic security priorities.

What China Gains from the Deal

For Beijing, strengthening ties with the UK sends a powerful geopolitical signal—especially to Western allies skeptical of China’s global role.

China benefits through:

Increased access to UK and European markets

Greater export potential for electric vehicles, solar technology, and renewable equipment

Expanded investment opportunities in British finance, technology, and green industries

Improved diplomatic credibility as a stable global partner

Chinese state media framed the visit as a step toward turning long-term cooperation potential into real-world economic outcomes.

Ongoing Challenges for Foreign Businesses

Despite the progress, international firms still face persistent obstacles in China, including:

Regulatory complexity

Bureaucratic hurdles

Limited transparency

Market access concerns

While UK companies remain optimistic, they acknowledge the need for careful navigation of China’s business environment.

Geopolitical Risks and US Pressure

Starmer’s China outreach comes amid heightened tensions with the United States. President Trump has warned allies—including the UK—against deepening economic ties with Beijing, even threatening punitive tariffs against countries that expand cooperation with China.

Starmer, however, maintains that Britain does not need to choose between Washington and Beijing, framing the strategy as a balanced, growth-focused foreign policy.

Global Context: A Broader Western Shift Toward China

The UK’s visit is part of a broader trend. Leaders from France, Canada, and Finland have also traveled to Beijing recently, seeking economic diversification amid uncertainty in US-led trade policy.

As middle powers attempt to hedge against global volatility, competition for Chinese investment and market access is expected to intensify.

Sir Keir Starmer’s China visit does not mark a dramatic policy revolution—but it does represent a strategic recalibration. The UK is betting on pragmatic engagement to boost economic growth while managing geopolitical risks.

Whether this diplomatic reset delivers long-term benefits will depend on how effectively both nations translate symbolic agreements into sustainable economic progress.

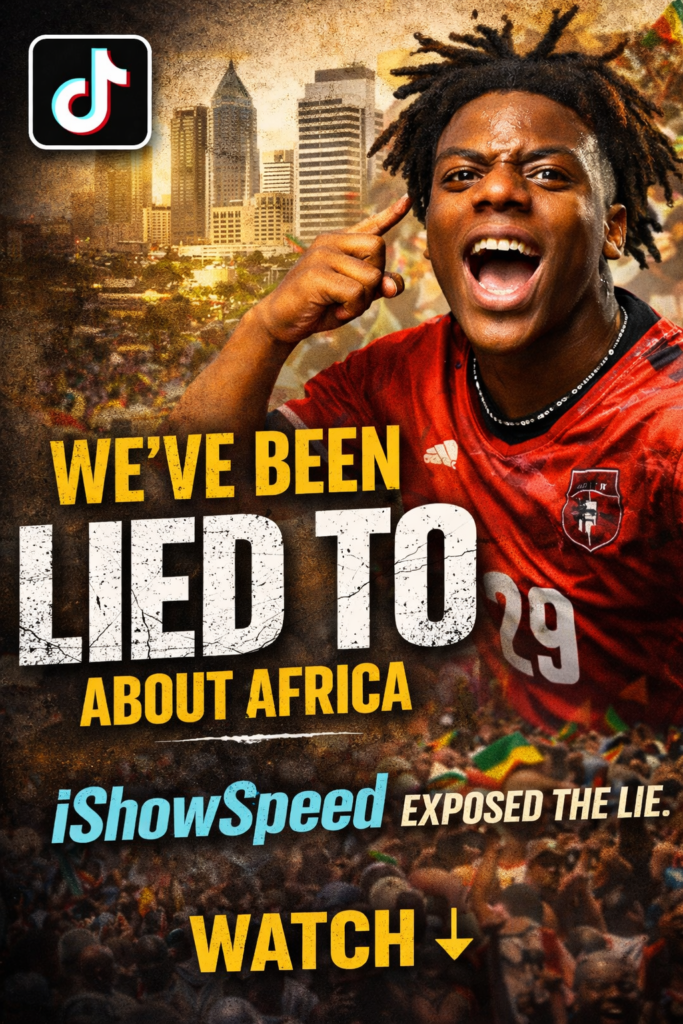

- IShowSpeed and the Collapse of the African Narrative

by Daniel Alison

by Daniel AlisonFor decades, Africa has been framed through a narrow and damaging lens. To much of the world—especially in the West—the continent has been reduced to images of poverty, conflict, and stagnation. It is a narrative shaped by selective media coverage, outdated documentaries, and inherited colonial assumptions.

Then, unexpectedly, a 19-year-old American streamer disrupted it.

When YouTube star IShowSpeed embarked on a livestreamed tour across several African countries, he didn’t arrive as a journalist, historian, or activist. He came as himself—unfiltered, unscripted, and visibly curious. What followed was not just a viral moment, but a real-time collapse of a long-standing global narrative.

A Reality Few Were Prepared to See

As Speed streamed from African cities, millions of viewers watched in disbelief. Not because Africa looked unfamiliar—but because it contradicted everything they had been taught to expect.

They saw modern infrastructure, vibrant street life, internet connectivity, music, fashion, laughter, and hospitality. They saw crowds welcoming Speed not as a spectacle, but as family. And most importantly, they saw a continent that looked alive, complex, and contemporary.

The dominant reaction online was not admiration—it was shock.

A recurring sentiment echoed across comment sections and reaction videos:

“We’ve been lied to.”

Contrast That Exposed the Lie

Earlier in his travels, Speed had toured parts of Europe, where he was met with open racism—monkey chants, banana-throwing, and hostility disguised as humor. The contrast was stark.

In Africa, the experience was the opposite. He was protected, celebrated, respected, and embraced. Not as a novelty, but as a brother.

That contrast forced uncomfortable questions: If Africa is “uncivilized,” why did it feel more humane?

If Europe is “developed,” why did it feel more hostile?

The Power of Unmediated Storytelling

What made Speed’s tour so powerful was not intention, but absence of mediation.

There were no institutional filters.

No political framing.

No expert commentary.

Just a peer sharing lived experience in real time.

This is where mainstream media failed—and why a streamer succeeded.

If these images had come from a tourism board, they would have been dismissed as propaganda.

If they came from a documentary, they would have been debated.

If they came from academia, they would have been ignored.

But they came from someone young people trust—because he feels like one of them.

https://youtube.com/shorts/4pt_EfqOVVk?si=CR_hRAX6M3DR5S6v

Africa Is Not a Country

One of the most glaring misconceptions exposed by this moment is the idea of Africa as a single place. Africa is a continent of 54 countries, each with distinct cultures, histories, economies, and realities.

Speed’s experience does not represent every African experience. Poverty exists. Conflict exists. Inequality exists—just as it does in the United States, Europe, and elsewhere.

But suffering is not Africa’s defining feature. Complexity is.

An Emotional Awakening, Not a Debate

This was not a policy discussion or an academic correction. It was an emotional awakening.

People do not change deeply held beliefs through statistics.

They change them through emotional proximity.

Speed didn’t argue.

He didn’t explain.

He simply reacted—with joy, curiosity, and wonder.

And those reactions persuaded millions more effectively than decades of lectures ever could.

A Shift in Global Influence

This moment signals something larger:

the decline of institutional narrative control.

Today, YouTube and livestreaming shape perception more powerfully than traditional media. Trust has shifted from institutions to individuals. From experts to peers. From scripts to experiences.

A teenager with a phone accomplished what global media networks failed to do over generations—by simply showing reality.

Reconnection Begins in the Mind

For many in the African diaspora, this moment carried deeper meaning. The lie was not only told about Africa—it was told to people of African descent worldwide. Separation was framed as rejection. Distance was framed as disinterest.

Speed’s journey quietly corrected that distortion.

Africa is not frozen in the past.

It is not waiting to be discovered.

It is living, evolving, imperfect, welcoming, and proud.

And when false filters fall away, truth moves freely.

Danchima Media

Challenging narratives. Restoring context. Telling the stories that matter.

- The Guardiola Blueprint: Manchester City’s Relentless, Costly Pursuit of Perfection

by Daniel Alison

by Daniel Alison

In the rarefied air of the Etihad Stadium, success is not merely measured in trophies—though there are plenty—but in microns of tactical margin, in the seamless execution of an idea. When Manchester City secures a signing, like the reported £65 million capture of Bournemouth’s Antoine Semenyo, the football world reacts with a now-familiar mixture of awe and exasperation. The transfer is another data point in the most expensive scientific experiment the sport has ever seen: the relentless, iterative pursuit of footballing perfection under Pep Guardiola.

For the rivals and the skeptics, the narrative writes itself. It is a story of endless chequebooks and cold disposal. Sign Nathan Aké for £45 million. Didn’t work? Go and spend £50 million on Khusanov, £31 million on Ait-Nouri. Give me João Cancelo for £60 million. Didn’t work? Drop £77 million on Josko Gvardiol.

The list, as fans on social media tirelessly chronicle, reads like a chronicle of excess: £100 million for Jack Grealish, £55 million for Jérémy Doku, £34 million for Savio, a rumored pursuit of Rayan Cherki. In midfield, the search for the elusive formula continues: £42 million for Kalvin Phillips, £53 million for Matheus Nunes, £25 million for Mateo Kovačić, and now, whispers of another £60 million for Fiorentina’s Nico González.

Manchester City last match against Manchester united

It is easy, from the outside, to view this as mere financial gluttony. A cynical cycle of buying, discarding, and buying again, funded by a bottomless well of sovereign wealth. The punchline is always ready: Here’s £80 million for Omar Marmoush, he’s a bum. Take another £65 million for Semenyo.

But to dismiss it as such is to miss the profound, almost philosophical heart of the Manchester City project. This is not scattergun spending. This is targeted, iterative problem-solving on a grand scale. Each “failed” signing is not a mistake to be mourned, but a hypothesis tested. Each successive purchase is a refined variable, a closer approximation of Guardiola’s ever-evolving vision.

The Catalan manager does not buy players; he acquires specialist tools for a specific, complex craft. If one chisel doesn’t hold its edge for the precise cut he needs, he finds another, regardless of cost. The mission—to execute his footballing ideal—is paramount. The financial outlay is merely the resource required to eliminate compromise.

For every Grealish who evolves into a crucial controller, there is a Cancelo whose brilliant individualism ultimately clashes with the system’s demands. The system is non-negotiable. The player, no matter the fee, is adaptable or expendable. It is a brutal calculus, but one executed with chilling efficiency.

This approach demands a particular kind of resilience from a player. It can be a cold environment, lacking the sentimental patience of a traditional club. Yet, for a certain breed of footballer, it represents the ultimate challenge: the chance to work under the game’s most demanding architect, to be a cog in the most finely tuned machine in football history. This, reportedly, is what attracted Semenyo—the chance to be forged by Pep.

New signing to Etihad The emotional cost of this model is the erosion of a romantic, patient narrative. There are no long-suffering heroes here, only temporary engineers of success. But the professional yield is unprecedented: a machine that learns, adapts, and improves with every transaction.

So, when the next £65 million signing is unveiled, remember: you are not just watching a transfer. You are witnessing the latest iteration of a blueprint. A draft revised, a formula tweaked, another step in a costly, heartless, and utterly relentless journey toward a perfect game. The rest of football can only look on, criticize the expense, and wonder if they’re even playing the same sport. - Bold Visions Meet Economic Reality in Davos 2026.

by Daniel Alison

by Daniel Alison

The 2026 World Economic Forum Annual Meeting in Davos, Switzerland, concluded against a backdrop of rising geopolitical tensions, rapid technological change, and renewed economic nationalism under the newly re-elected U.S. President Donald Trump.

Business leaders, policymakers, and innovators gathered to confront the defining questions of the moment: how artificial intelligence will reshape work, how trade wars may redraw global supply chains, and whether governments can balance growth with stability in an era of disruption.

Drawing from coverage by Yahoo Finance, here are the key takeaways shaping markets, boardrooms, and policy debates worldwide.

Elon Musk’s Davos speak

Global Economy: Tariffs, Deficits, and the Future of the Fed

Economic policy dominated much of the Davos conversation, with U.S. leadership setting the tone.

President Trump outlined an aggressive domestic agenda centered on tariffs, energy expansion, and housing affordability. He argued that “homes are built for people, not corporations,” and floated a controversial proposal to cap credit card interest rates at 10% for one year — a move sharply criticized by JPMorgan Chase CEO Jamie Dimon, who warned it could trigger unintended economic consequences.

Trump also hinted at a near-term announcement for a new Federal Reserve chair, with Jerome Powell’s term set to expire in May. The signal alone stirred speculation about future monetary policy, inflation control, and market volatility.

The cybersecurity treat

Dimon, a frequent focal point at Davos, expressed fatigue over repeated questions about Trump’s agenda, bluntly remarking, “What the hell else do you want me to say?” Still, he acknowledged that tariffs remain a strategic “pressure point” on China, even as concerns grow over ballooning U.S. deficits.

Former Federal Reserve Vice Chair Lael Brainard offered a more structural warning, noting that AI-driven productivity gains risk concentrating growth at the top while leaving much of the broader economy stagnant.

Dimon added a sobering forecast of his own: JPMorgan is likely to employ fewer people within five years due to AI adoption — a stark reminder of looming workforce disruptions.

Technology Takes Center Stage: AI, Automation, and Robotics

If there was one dominant theme at Davos 2026, it was artificial intelligence.

Nvidia CEO Jensen Huang dismissed fears of an AI bubble, calling current infrastructure spending “sensible” and describing AI development as a “five-layer cake” — complex, foundational, and still in its early stages. In a discussion with BlackRock CEO Larry Fink, Huang argued that AI will ultimately create more jobs than it eliminates, though not without painful transitions.

Elon Musk once again delivered some of the summit’s most headline-grabbing moments. The Tesla and SpaceX CEO predicted that humanoid robots will reach the consumer market by the end of next year, eventually becoming as common as smartphones. He also projected widespread adoption of Tesla’s Robotaxi services in the U.S. before 2027, alongside rapid progress toward full self-driving vehicles.

Other tech leaders offered more measured optimism. Affirm CEO Max Levchin argued that AI will fundamentally transform retail without replacing major players like Walmart. Reddit co-founder Alexis Ohanian highlighted AI’s potential to democratize access to knowledge, particularly in education and agriculture.

President Trump, however, injected skepticism into the AI frenzy, openly questioning Meta’s reported $50 billion investment in AI data centers: “How do you spend $50 billion?” he asked, echoing concerns among investors about capital efficiency and returns.

Liverpool Crisis

Geopolitics: Trade, Security, and Strategic Alliances

Geopolitical tensions ran beneath nearly every discussion.

Trump reignited controversy by reiterating U.S. interest in acquiring Greenland — not for rare earth minerals, he claimed, but for “international security.” He warned that NATO allies unwilling to support such moves could face tariffs, linking economic pressure directly to defense commitments.

U.S.–China relations also loomed large. While tariffs remain a central tool of U.S. policy, leaders acknowledged the growing difficulty of full economic decoupling. Dimon emphasized the complexity of maintaining competition without triggering systemic instability in global markets.

Energy, Sustainability, and the Bigger Picture

While sustainability was not the headline focus of Davos 2026, it surfaced indirectly through energy discussions. The prevailing tone favored an “all-of-the-above” strategy, emphasizing expanded domestic energy production as a hedge against geopolitical risk and supply shocks.

The absence of a strong climate narrative itself spoke volumes, reflecting a broader shift toward economic security and industrial resilience over long-term environmental commitments.https://youtube.com/@danchimatv?si=kz-5cZX3-FNYZOLq

What Davos 2026 Signals for Markets and Investors

Davos 2026 delivered a clear message: the world is entering a high-volatility era defined by policy uncertainty, technological acceleration, and geopolitical recalibration.

Artificial intelligence is widely seen as the next major growth engine — but one that may deepen inequality and displace workers before benefits are broadly shared. At the same time, aggressive trade policies and potential shifts in U.S. monetary leadership could inject fresh turbulence into global markets.

For investors, executives, and policymakers alike, Davos reinforced a central truth of the moment: in an age of disruption, the intersection of government power and technological influence will define the financial landscape ahead.

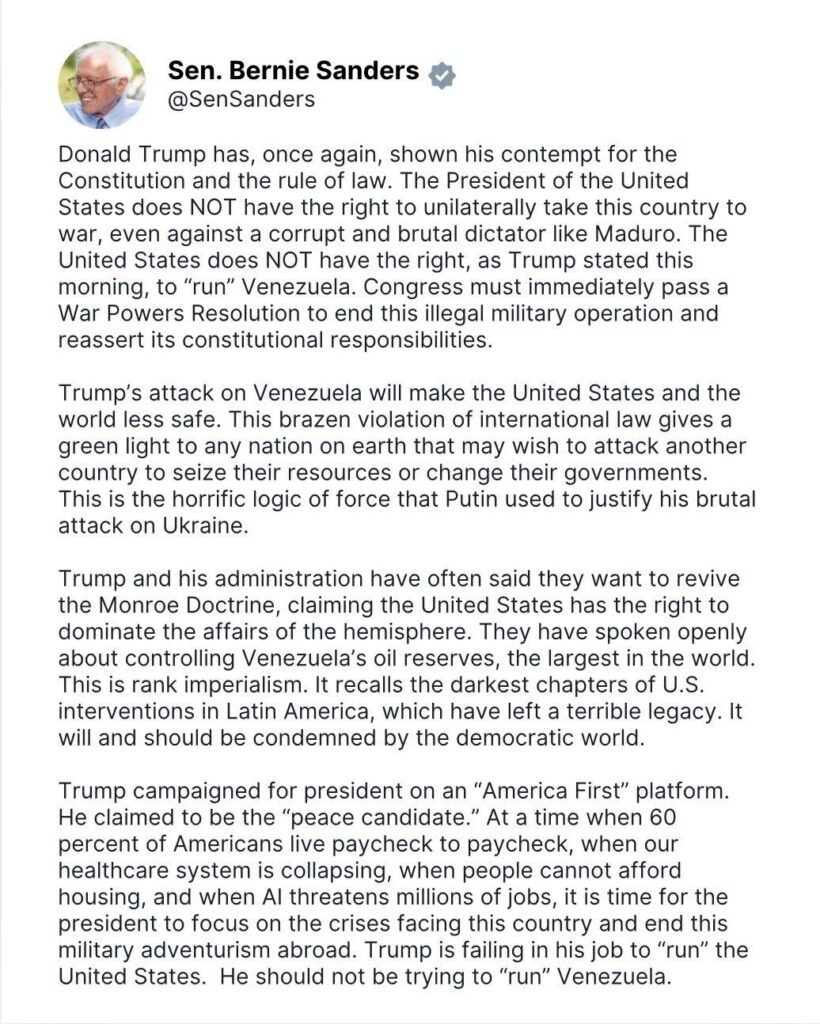

- The United Nations’ Double Standard and America’s Global Bullying Problem

by Daniel Alison

by Daniel AlisonFor decades, the United Nations has presented itself as the moral compass of the international system—a neutral arbiter committed to peace, sovereignty, and the rule of law. Yet in practice, its conduct exposes a troubling double standard, one that consistently shields powerful states while disciplining weaker ones. Nowhere is this hypocrisy more evident than in the unchecked bullying posture of the United States on the global stage.

The UN is swift to condemn elections, internal politics, or security measures in developing nations. Sanctions are imposed, leaders are delegitimized, and sovereignty is questioned—often based on vague accusations or politicized reports. But when the United States engages in military interventions, economic warfare, covert destabilization, or violations of international law, the UN suddenly becomes cautious, procedural, and silent.

This is not coincidence. It is design.

The structure of the United Nations—particularly the Security Council veto—ensures that powerful states, especially the United States and its allies, remain effectively untouchable. International law is not applied universally; it is selectively enforced. Justice is not blind; it is strategic.

The United States has normalized a culture of intimidation in international relations. Through unilateral sanctions that cripple civilian populations, military bases encircling sovereign nations, and regime-change operations disguised as “democracy promotion,” Washington operates less like a partner in global governance and more like a global enforcer answerable to no one.

When nations resist this pressure, they are labeled “rogue states,” “authoritarian regimes,” or “threats to democracy.” Their leaders are demonized. Their economies are strangled. Their people are made to suffer—not as collateral damage, but as leverage.

And the United Nations? It issues statements.

This passivity is not neutrality. It is complicity.

By failing to confront U.S. aggression with the same urgency applied to weaker states, the UN has undermined its own credibility. It has become an institution that manages power imbalances rather than corrects them—one that legitimizes coercion through silence and normalizes abuse through selective outrage.

The consequences are profound. Smaller nations learn that international law will not protect them. Sovereignty becomes conditional. Multilateralism becomes a myth. And the UN, rather than serving as a shield for humanity, becomes a stage where power performs legitimacy.

If the United Nations is unwilling or unable to hold the United States to the same standards it imposes on others, then it cannot claim moral authority. An institution that excuses bullying while punishing resistance is not a guardian of peace—it is an accessory to domination.

Sanders post

The world does not need a rules-based order where only the weak must obey the rules. It needs genuine accountability, equal sovereignty, and an international system that restrains power rather than worships it.

Until that transformation occurs, calls for reform will ring hollow, and the United Nations will continue its slow descent from global conscience to ceremonial spectator—watching injustice unfold, one double standard at a time.

- FOREIGN AIRSTRIKES WILL NOT SOLVE NIGERIA’S INSECURITY

by Daniel Alison

by Daniel AlisonThe Federal Government’s acknowledgement of intelligence cooperation with the United States—particularly around possible airstrikes against terrorist groups—should concern every Nigerian who understands the true nature of the country’s insecurity crisis.

Nigeria’s security problem is not religious.

It is a governance failure.

For years, armed groups have ravaged communities, displaced millions, and steadily weakened national unity. Throughout this period, intelligence reports, investigative journalism, and public allegations have repeatedly pointed to influential individuals—both within and outside government—who allegedly sponsor, finance, arm, or facilitate terrorism, often through cross-border networks from the Sahel. Yet the Nigerian state has consistently failed, or refused, to arrest, prosecute, and secure convictions against these powerful actors.

That failure lies at the heart of Nigeria’s insecurity.

Rather than enforce the law against those at the top, the government has chosen the path of least resistance: disarming ordinary citizens, restricting lawful self-defence, and leaving vulnerable communities exposed to violent attacks. A state that denies its people the right to protect themselves, while shielding alleged sponsors of terror, has effectively abandoned its constitutional duty.

It is against this backdrop that foreign military involvement is now being presented as a solution. It is not.

Nigeria does not need the United States, Israel, or any foreign power to secure its territory. History clearly shows that external military intervention rarely cures internal governance failures. Afghanistan was “secured” and later handed back to the Taliban. Iraq was “liberated” and left deeply fractured. Libya was “saved” through foreign intervention; Muammar Gaddafi was killed, and the state collapsed into chaos. Syria today is controlled by actors once labelled terrorists, now selectively legitimised by foreign interests.

These are not success stories. They are cautionary tales.

It is therefore misleading—and dangerous—to frame foreign involvement as an effort to protect Christians or to wage war against Islam in Nigeria. Leaders such as Donald Trump and Benjamin Netanyahu presided over unresolved conflicts and serious human rights concerns within their own spheres. They cannot credibly present themselves as guardians of Nigerian lives.

Even more troubling is the risk that foreign intervention will recast Nigeria’s crisis as a religious war. Nigeria’s insecurity is not Christianity versus Islam. It is impunity versus justice. It is elite protection versus accountability.

If Nigeria allows this crisis to be reframed along religious lines, the consequences will be devastating. Such a conflict will not be confined to forests and remote areas. It will engulf cities, towns, villages, and homes—tearing the country apart in ways that may be impossible to reverse.

Nigeria does not need foreign bombs.

Nigeria needs effective law enforcement.

Nigeria needs arrests, prosecutions, and convictions of terror sponsors—no matter how highly placed they may be.

Above all, Nigeria needs a government willing to apply the law without fear or favour.

Until justice is enforced, no intelligence sharing, no airstrike, and no foreign partnership will deliver peace.

Security without justice is nothing more than an illusion.

US airstrikes missed target, missiles hit empty field – Ex-FRCN DG Salihu

Ladan Salihu, former Director-General of the Federal Radio Corporation of Nigeria, FRCN, has criticized the United States, US, airstrike carried out on Christmas night in Jabo village, Sokoto State, saying it failed to hit its target and was not accurate. On December 25, the US carried out several airstrikes aimed at ISIS fighters in Sokoto, located in north-west Nigeria.

The US Africa Command, AFRICOM, later explained on X that the operation was carried out with the collaboration of the Nigerian government.

AFRICOM said the attack showed the strength of the US military and its determination to stop terrorist threats both within the US and in other countries.

However, Salihu shared a different account in a post on X, saying he personally spoke with Bashar Isah Jabo, a member of the Sokoto State House of Assembly, who visited the affected area shortly after the strike.

According to the lawmaker, the missiles fell on an open field about 300 meters away from a local hospital. No one was injured or killed in the incident.

Salihu added that Jabo village had not experienced any terrorist activity or ISWAP presence throughout 2025. He said there were also no records of farmer-herder conflicts in the area.

He explained that villagers only found missile fragments near a large crater, with no damage to homes or loss of life.

Salihu questioned the purpose of the strike and wondered if it was meant to make headlines rather than eliminate real threats.

While supporting cooperation to fight terrorism, he said attacks should focus on known terrorist leaders and strongholds.

He called on Nigeria’s Defence Headquarters to investigate the incident and provide a clear report to the public.

Salihu also expressed relief that the missiles did not hit the hospital or harm innocent residents of Jabo village.

“I just spoke with Hon Sarkin Yaki Jabo Member Sokoto State Assembly who visited Jabo after the strike at 10:30pm last night. The US strike in Jabo near Tambuwal wasn’t a precision strike. No casualties. Missiles landed in a plain field 300metres away from a Local Hospital,” he said.

- Cutting Corners on Crypto Security: A Costly Lesson

by Daniel Alison

by Daniel AlisonIn a stark reminder of the risks in the cryptocurrency world, an investor recently lost 4.35 BTC—worth over half a million dollars—after purchasing a hardware wallet from an unverified seller.

According to reports, the device had been tampered with before purchase. The seed phrase, which serves as the master key to a crypto wallet, was pre-set and known to the scammer. Once the buyer transferred funds into the wallet, the attacker immediately swept them away.

The incident highlights a dangerous but common mistake: trying to save a small amount of money by buying security devices from unofficial sources. While the buyer may have saved a few hundred dollars on the purchase, the decision ultimately cost them a fortune.

Security experts warn that cryptocurrency hardware wallets should only be purchased directly from the manufacturer or authorized resellers to ensure their integrity. Any compromise in the supply chain opens the door to pre-installed vulnerabilities, making it trivial for scammers to drain funds.

In the crypto space, trust and security are everything. One wrong move—or one shady purchase—can wipe out years of savings in seconds. - Liverpool Searching for Clear Skies After Seven Months of Turmoil

by Daniel Alison

by Daniel AlisonWhen Virgil van Dijk lifted the Premier League trophy at Anfield on a cool May afternoon, it felt like the perfect conclusion to a season defined by control, confidence, and calm authority. Liverpool’s march to a 20th league title had been impressive not because of relentless drama, but because of how smoothly obstacles were handled. Problems arose, but they were solved with composure. The title was secured with barely a strain.

The celebrations after a 1–1 draw with Crystal Palace on the final day matched the mood. Players danced on the pitch, supporters filled the stands with joy, and there was no sense that Liverpool had reached a peak they could not sustain. Confidence was high. The future looked bright.

That optimism vanished almost immediately.

Within 24 hours, Liverpool’s world tilted. What followed has been one of the most extraordinary and painful seven-month stretches in the club’s long history — a period marked by tragedy, chaos, emotional exhaustion, and sporting collapse.

It began with what should have been a historic triumph: a trophy parade through the city on Monday, 26 May. Thousands lined the 10-mile route, braving heavy rain to celebrate their champions. Van Dijk stood atop the open-top bus, trophy in hand, sunglasses on, music blaring — a scene of pure joy.

Then came horror.

A car drove into the crowd, injuring more than 130 people, from a six-month-old baby to a 77-year-old woman. The moment forever scarred what should have been a day of celebration. Earlier this month, Paul Doyle, a 54-year-old father of three, was sentenced to more than 21 years in prison. While that verdict offers some closure, the emotional wounds will never fully heal.

As the city was still processing that trauma, another devastating blow followed. In July, Liverpool forward Diogo Jota died suddenly. The loss of a beloved teammate, friend, and professional is impossible to measure. Its impact continues to ripple through the squad.

Andy Robertson’s words months later captured the depth of that grief. Speaking after Scotland secured World Cup qualification, the defender admitted he had struggled to cope. Jota had been a constant presence in his thoughts — a teammate with whom he had often spoken about sharing the World Cup stage. The grief, Robertson revealed, had not faded.

It still hasn’t.

That emotional weight has bled into Liverpool’s performances, which have been alarmingly poor. A side once defined by control and resilience has unraveled. Nine defeats in 12 matches told a brutal story, culminating in a disastrous run where 10 goals were conceded across three games due to collective panic and individual errors.

It was Liverpool’s worst sequence since the 1953–54 season.

This collapse is all the more shocking given the scale of the club’s ambition. Over the summer, Liverpool shattered the British transfer record by signing Alexander Isak for £125 million, pushing total spending beyond £440 million. Florian Wirtz, Hugo Ekitiké, and other high-profile additions suggested a dynasty in the making.

Instead, everything has gone wrong.

Isak is now sidelined for months with a fractured leg. Giovanni Leoni’s season ended almost before it began due to a serious knee injury on his debut. Mohamed Salah is away on Africa Cup of Nations duty and may never play for the club again following his revealing post-match interview at Leeds. Discipline issues have surfaced too, including Ekitiké being sent off for a needless shirt-removal celebration.

Champions of England Chaos has become routine.

Yet amid the storm, calls for patience remain. Football writer and lifelong Liverpool supporter Andrew Beasley argues that Arne Slot deserves time. With so much investment in a new squad, replacing the head coach now would only deepen the instability. Proven, serial title-winning managers are rare. Slot must be given space to shape what he has inherited.

That argument holds weight, even if Slot himself has made questionable decisions. His tactics, selections, and squad management have at times contributed to the problems. But he has also shown empathy, dignity, and leadership during moments no coach should ever have to face. From the parade tragedy to Jota’s death, Slot has carried responsibilities far beyond football.

As the festive period passes and the new year approaches, what Slot — and Liverpool — crave most is something simple: calm.

A home fixture against Wolves offers that possibility. With just two points from 17 games, Wolves are on track for a historically poor Premier League season. On paper, this should be straightforward.

But for Liverpool, nothing has been straightforward since that joyful spring day now fading into memory.

The storm has been long. The hope at Anfield is that clearer skies finally lie ahead.

- Jake Paul’s Reality Check: What Anthony Joshua’s Fists Mean for Boxing Fans in Nigeria

by Daniel Alison

by Daniel Alison

Jake Paul’s much-talked-about fight with Anthony Joshua ended the way many African boxing fans predicted — with a harsh lesson in real heavyweight boxing.

The American influencer-turned-boxer has now undergone surgery after suffering two fractures to his jaw, with doctors fitting titanium plates following his stoppage defeat to Joshua in Miami. Several teeth were also removed in the process.

For fans across Nigeria and Africa, the outcome felt less like a shock and more like confirmation: boxing at the highest level is not content creation — it is warfare.

Joshua, a former two-time world heavyweight champion with deep roots admired across Africa, dropped Paul repeatedly before the referee ended the contest in the sixth round. Paul could not beat the count, marking the first stoppage loss of his professional career.

Why African Fans Never Bought the Hype

In Nigeria, Ghana, South Africa and beyond, boxing fans have long respected one thing above all else: pedigree.

From Hogan “Kid” Bassey to Samuel Peter and modern champions across the continent, African fight culture understands the cost of stepping into the ring unprepared. Paul’s leap from cruiserweight bouts into the heavyweight elite raised eyebrows long before the first bell rang.

The weight difference.

The experience gap.

The championship mentality.

All of it showed.

While Paul tried to rely on movement and speed, Joshua’s calm pressure and explosive power made the difference — a reminder that heavyweight boxing punishes mistakes instantly.

A Lesson for the New Generation of Fighters

Paul’s broken jaw is already being talked about in Nigerian gyms and viewing centres. The message is simple:

> There are levels to this game.Social media fame can sell tickets, but it cannot replace years of sparring, discipline, and damage absorbed behind closed gym doors.

Still, African audiences also respect courage. Paul stepped into dangerous territory, and that earns him some respect — even in defeat.

What Comes Next for Jake Paul?

Paul has announced he will take time off to heal and return to cruiserweight, where he hopes to chase a world title. That path makes far more sense and could keep his boxing ambitions alive.

A future rematch with Tommy Fury remains possible, and Paul has continued to talk about a mega-fight with Canelo Alvarez — though many fans believe that talk now belongs strictly to promotion, not reality.

Final Word: Joshua Wins More Than a Fight

For Anthony Joshua, this victory was more than just another payday. It was a statement — not just to Paul, but to the wider boxing world watching from Africa to Europe.

In Nigeria especially, Joshua’s win reinforced something deeply familiar:

> Respect the craft. Respect the ring.

Because when the bell rings, boxing stops being entertainment — and starts demanding payment in blood, bone, and humility.

OPINION: Arsenal Are Better Than Before — But Manchester City Are Still Inevitable

Let’s stop pretending.

Every December, the Premier League convinces itself that this might finally be the year Manchester City blink. And every spring, Pep Guardiola reminds everyone why hope is dangerous.

Arsenal are top of the table again. They are organised, mature, and far more resilient than in previous seasons. Yet the same uncomfortable truth hangs over this title race:

Manchester City don’t need to be perfect early — they only need to be close.

And right now, they are.

The Smile That Should Worry Arsenal

Pep Guardiola criticised his team after a 3–0 win, laughed with reporters, joked with players, and looked completely at ease. That combination should set off alarm bells across North London.

When City struggle, Guardiola is tense.

When City are drifting, Guardiola is defensive.

When City are about to explode into a title run, Guardiola is relaxed.We’ve seen this movie too many times.

Arsenal fans remember December leads. Guardiola remembers May trophies.

Arsenal Are Leading — And That’s the Problem

Leading a title race is not the same as controlling one.

Arsenal must win every week knowing City are lurking. City chase knowing Arsenal cannot afford a slip. That psychological imbalance matters more than tactics.

The Gunners now win ugly games — a real improvement. But ugly wins don’t erase the scars of collapses past. Pressure doesn’t disappear just because lessons were learned.

City don’t carry scars. They carry memories of celebrations.