|

Getting your Trinity Audio player ready...

|

BlackRock just sent shockwaves through the crypto community—not by launching another Bitcoin ETF, but by challenging one of Bitcoin’s most fundamental principles.

In a recent educational video, BlackRock subtly suggested that there’s “no guarantee” the 21 million Bitcoin supply cap will remain intact. This statement directly contradicts Bitcoin’s core philosophy—its fixed supply, decentralization, and immutable code.

Wall Street vs. Bitcoin’s Core Values

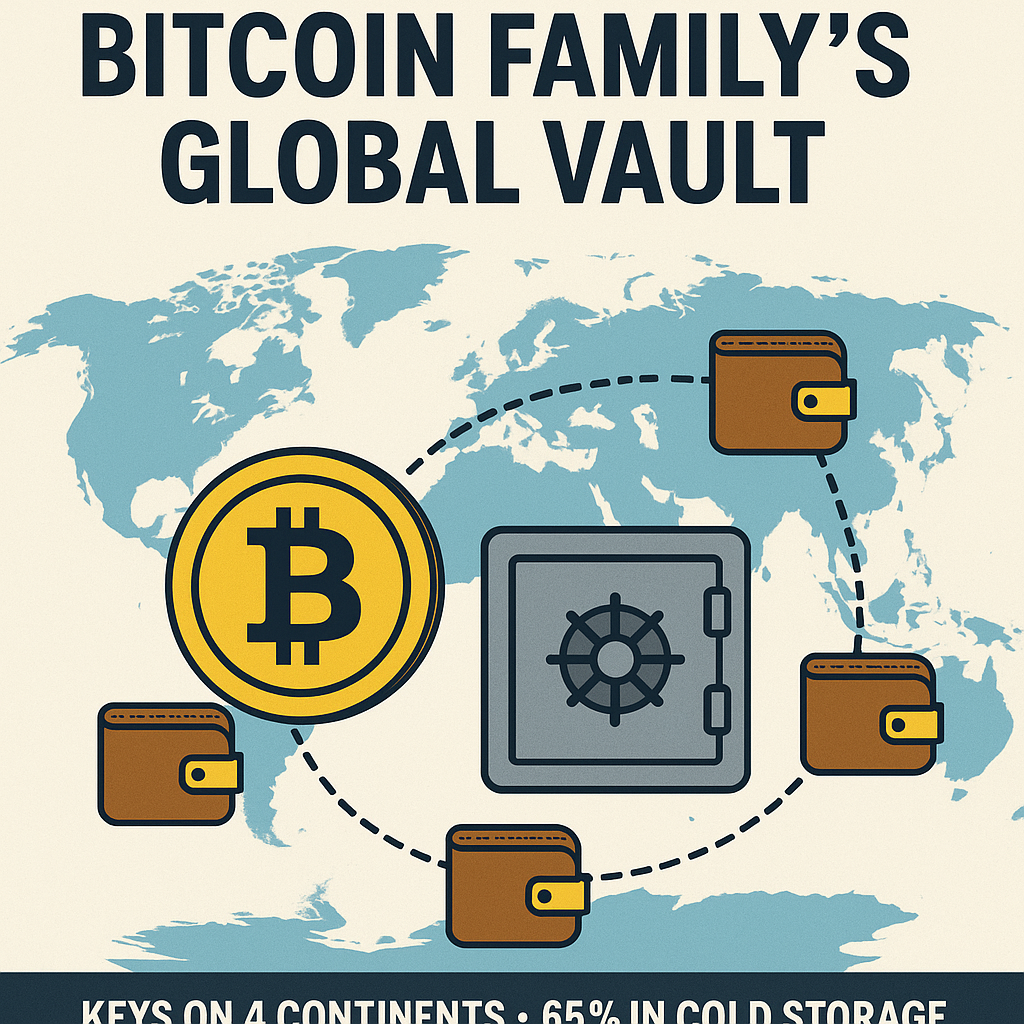

For years, Bitcoin has thrived as a decentralized system, free from corporate or governmental control. Its 21 million supply cap isn’t just a random number—it’s a fundamental feature built into the code, ensuring scarcity and protecting it from inflationary manipulation.

But BlackRock’s narrative shift raises questions:

Misunderstanding or Misinformation? Did BlackRock genuinely misunderstand how Bitcoin works, or is this a deliberate attempt to plant doubt in the minds of investors?

Wall Street Control Play? By normalizing the idea that Bitcoin’s supply cap could change, are institutions laying the groundwork for eventual centralization and control?

Fear, Uncertainty, Doubt (FUD)? Crypto enthusiasts were quick to call this classic Wall Street disinfo, designed to shake confidence in Bitcoin’s decentralized nature.

The Reality: Can Bitcoin’s Supply Cap Change?

Technically, changing Bitcoin’s 21 million cap would require a major network consensus—meaning the vast majority of Bitcoin nodes and miners would have to agree to it. Given that Bitcoin’s decentralization is its greatest strength, such a shift is highly unlikely. Even if some institutions wanted it, Bitcoin’s global network would resist any attempt at dilution.

The Bigger Picture

This isn’t just about a misleading statement in an educational video—it’s about how traditional finance is trying to reshape the narrative around Bitcoin. Wall Street firms are embracing Bitcoin on one hand, while subtly undermining its principles on the other.

For crypto purists, the message is clear: Bitcoin doesn’t need BlackRock—but BlackRock needs Bitcoin. And as institutional players step in, the fight to protect Bitcoin’s original vision is more important than ever.

- A Planet Under Pressure – Floods, Fires, and the Rising Toll of Climate Extremes

- The era of wild Bitcoin price swings is coming to an end

- Trump’s Tariffs, Bitcoin Dump, and Strange SEC Activity — What’s Happening?

- What to Do With Your Money After the New Budget

- Trump to Meet Putin “Over Next Two Weeks”

- Pep Guardiola Slams Man City Squad Players After 2–0 Champions League Defeat to Bayer Leverkusen

- Guardiola ‘Embarrassed and Ashamed’ After Confrontation With Cameraman Following Man City Defeat

- London Calling: The Perfect Christmas Shopping Escape From Graz

- Arsenal Injury Update: Latest on Gabriel, Gyokeres and Calafiori Ahead of North London Derby

- Another Warning Sign for Austria’s Industrial Future

- Labour Faces Internal Backlash as Shabana Mahmood Unveils Tougher Asylum Reforms

- Bitcoin Slides Below $93K as Market Weakness Deepens