|

Getting your Trinity Audio player ready...

|

Standard Chartered Predicts Bitcoin Will Reach $500,000 as SEC Filings Over the Past Year Fuel Demand

The rapid rise of Bitcoin to $500,000 has just gained serious momentum as sovereign funds and large institutions ramp up, confirming an ultra-bullish trend.

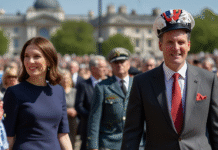

This week, Standard Chartered Bank reaffirmed its long-term forecast for Bitcoin.

By the end of Donald Trump’s second term, the cryptocurrency’s price is expected to rise to $500,000. In a published report, Jeffrey Kendrick, head of the bank’s global digital asset research division, referenced recently released information about investments in BTC. Kendrick stated:

“The latest data from the U.S. Securities and Exchange Commission (SEC) over the past 13 months confirms our core thesis that Bitcoin will reach $500,000 before Trump leaves office, as it attracts a broader range of institutional buyers.”

The 13F data refers to quarterly reports that the SEC requires investment managers with assets under management of over $100 million to file, detailing their equity holdings.

The Standard Chartered report highlights the growing trend of sovereign accumulation of shares in Strategy (Nasdaq: MSTR), which are used as intermediaries for holding Bitcoin due to regulatory restrictions on direct ownership of cryptocurrencies.

France and Saudi Arabia have opened MSTR positions for the first time, while companies in Norway, Switzerland, and South Korea have added new positions to existing ones.

Several U.S. state pension funds, including those from California, New York, North Carolina, and Kentucky, collectively acquired over 1,000 Bitcoins.

Kendrick sees broader implications for Bitcoin’s price trajectory: “The quarterly data over the past 13 months is the best confirmation of our thesis that BTC will attract new institutional buyers as the market develops, helping the price reach our target level of $500,000.”

“When institutions buy Bitcoin, prices tend to rise.” Although concerns about regulatory clarity and volatility remain, Bitcoin advocates view sovereign and institutional accumulation as a bullish indicator of long-term value appreciation.

The year 2025 will be pivotal in the policies of institutional funds and the budgetary policies of states.

By the end of the year, institutional demand for Bitcoin could double.