|

Getting your Trinity Audio player ready...

|

The GENIUS Act becomes the first major U.S. crypto law—ushering in a new era for stablecoins and digital finance.

Trump Makes History with First Federal Crypto Law

President Donald Trump has officially signed the GENIUS Act, marking the United States’ first major federal legislation on cryptocurrency. The law specifically targets stablecoins—a type of cryptocurrency backed by stable assets like the U.S. dollar—and aims to bring more clarity and regulation to the rapidly growing digital finance sector.

“We’ve made America the crypto capital of the world,” Trump declared during the signing ceremony at the White House.

🏛️ What the GENIUS Act Does

Passed with bipartisan support in both chambers of Congress, the GENIUS Act provides a regulatory framework that:

- Makes it easier for banks and institutions to issue stablecoins

- Promotes public trust in digital currencies

- Expands federal oversight of the crypto industry

- The law sets a six-month deadline for federal regulators to define specific rules and enforcement mechanisms.

💼 Trump’s Growing Crypto Ties Raise Eyebrows

While Trump was once a critic of crypto, he now touts himself as the most crypto-friendly U.S. president. He even launched his own $TRUMP meme coin earlier this year and has financial ties to World Liberty Financial, a crypto company that recently launched USD1, a U.S. dollar–pegged stablecoin. Though Trump’s role at the company has been downgraded from “Chief Crypto Advocate” to “Co-Founder Emeritus,” the Trump family still owns 60% of the firm.

⚖️ Critics Warn of Conflicts of Interest

Not all lawmakers are convinced the GENIUS Act protects the public.

“This law creates an illusion of federal oversight,” said Rep. Maxine Waters, citing concerns about Trump-linked firms profiting from stablecoin adoption.

Critics argue that public officials should not be allowed to launch or promote personal crypto projects while in office.

What’s Next?

- Regulators now have 180 days to implement the law.

- The House also passed the CLARITY Act, which defines which crypto assets fall under the jurisdiction of the SEC or CFTC—pending Senate approval.

With these legislative milestones, the U.S. is poised to become a dominant force in global crypto regulation—but not without controversy.

📊 Crypto and Politics: A New Frontier

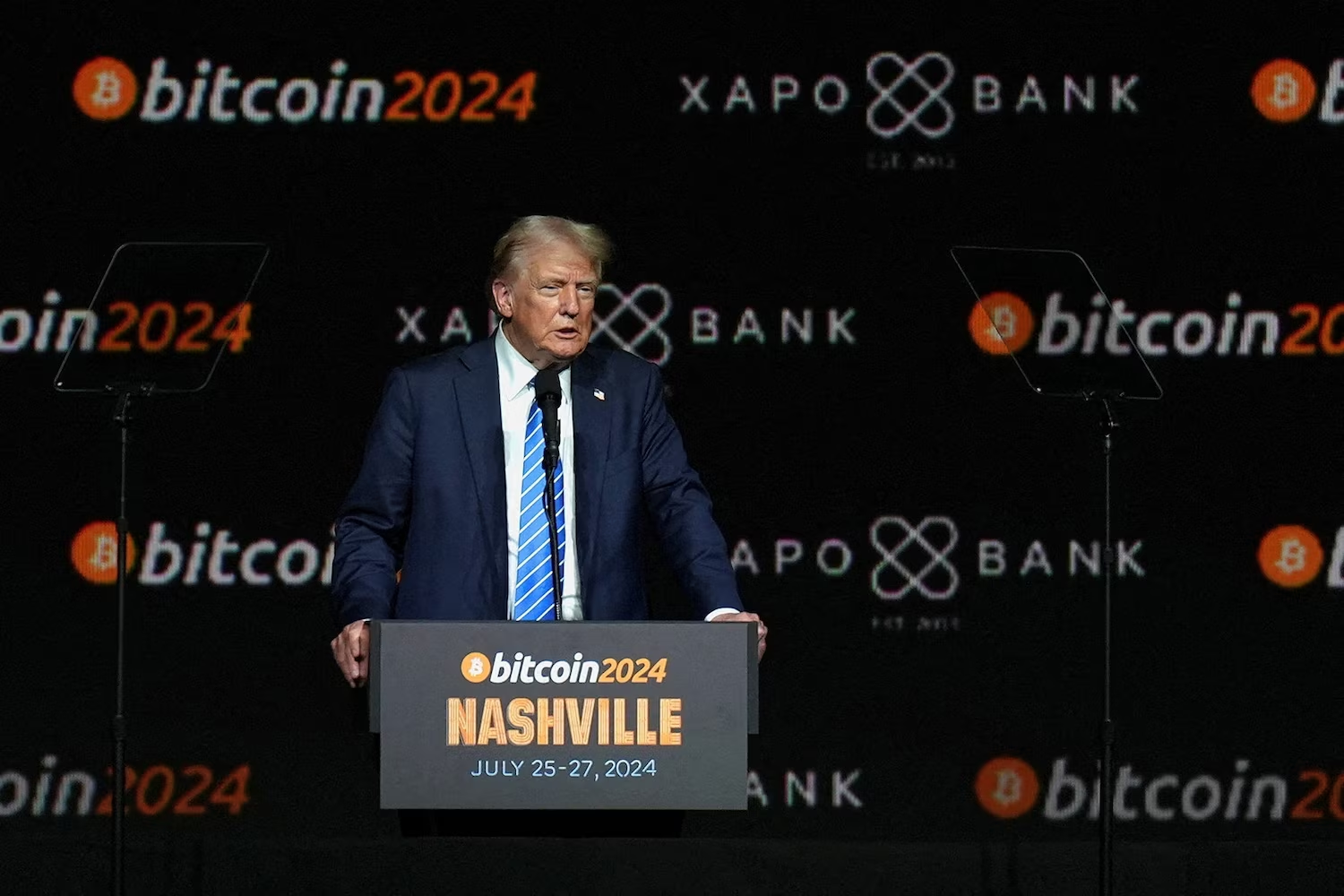

Trump’s bold crypto push signals a shift in Washington’s approach to digital assets. As the 2024 Bitcoin conference in Nashville showed, politics and blockchain are becoming deeply intertwined.

How the U.S. balances innovation, regulation, and ethics in this space could shape the financial future—not just for Americans, but for the entire world.