|

Getting your Trinity Audio player ready...

|

From a $600k meme coin call to a $1.2B DEX position and a $100M wipeout, James Wynn’s story blurs the lines between genius, gambler, and myth.

In the ever-unfolding saga of crypto Twitter (CT), few names have burned as brightly — or crashed as spectacularly — as James Wynn. His story isn’t just about big wins or bigger losses. It’s about the culture, the hype, and the razor-thin line between brilliance and recklessness in the age of decentralized finance.

Whether he was a master trader, a reckless degen, or a marketing mirage crafted to promote Hyperliquid (HL), James Wynn’s saga has already cemented itself in the annals of CT history.

The Early Signal: $PEPE at $600K Market Cap

James Wynn first made waves when he publicly called $PEPE, the now-iconic memecoin, at a mere $600,000 market cap. That call alone would be enough to grant someone crypto clout for life. PEPE went on to explode into the hundreds of millions, and possibly beyond — turning early buyers into overnight millionaires. This single call introduced Wynn as someone who either had an incredible gut instinct, inside alpha, or just a crazy amount of luck. It was his ticket into CT’s inner circle of attention.

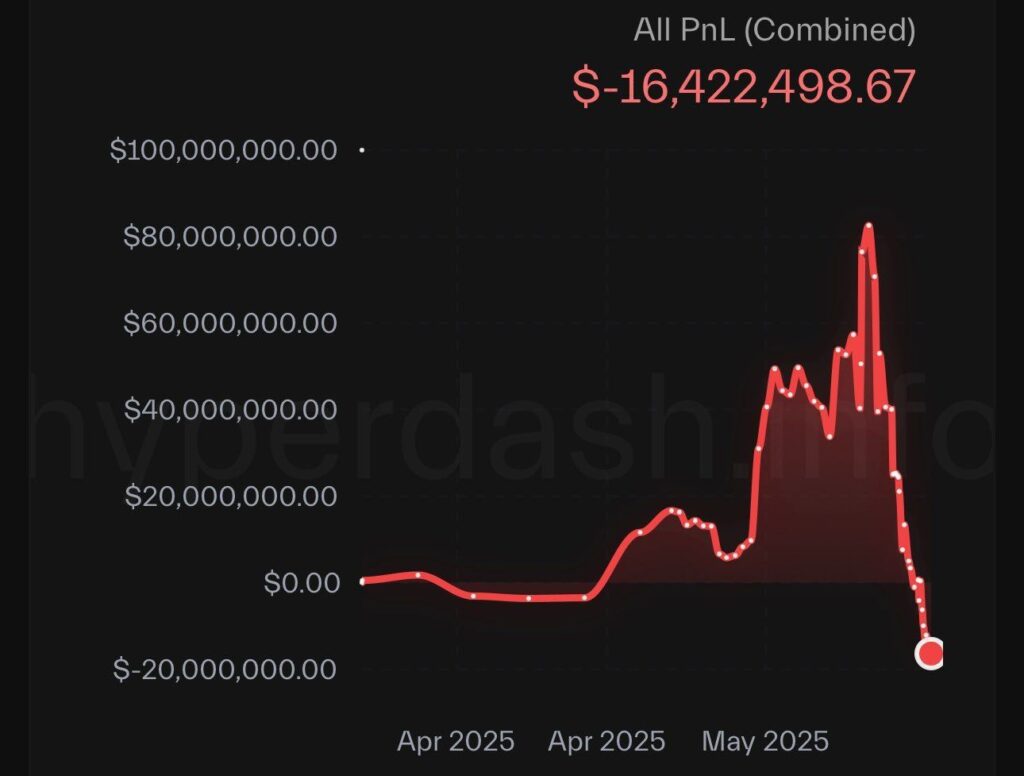

The Meteoric Rise: $550K → $87M in 70 Days

But the PEPE call was just the prelude. Wynn shot to #1 trader on Hyperliquid, a decentralized perpetuals exchange, by flipping $550,000 into $87 million in just 70 days.

The CT crowd watched in real-time as Wynn posted trades that looked like pure wizardry. His win streak was improbable, bordering on impossible. Every trade seemed to hit, every position went parabolic. He was the man of the moment — hailed by some as the Michael Jordan of on-chain leverage.

People speculated endlessly: Was he a bot? A trading firm front? A product of insider flows? Or just someone with an unholy ability to ride volatility?

Whatever the truth, one thing was clear: he was winning — big.

The Apex: $1.2 Billion BTC Long

Wynn eventually took a position that would go down as the largest in DEX history: a staggering $1.2 billion long on Bitcoin.

It was bold. It was reckless. It was CT catnip.

For a brief moment, he looked like a trading god, riding the ultimate wave on-chain. The sheer audacity of the position made headlines across DeFi corners and beyond. His followers ballooned. Memes flooded the timeline. Crypto influencers saluted him. This wasn’t just trading — it was performance art.

The Fall: A $100M Roundtrip and a Vanishing Act

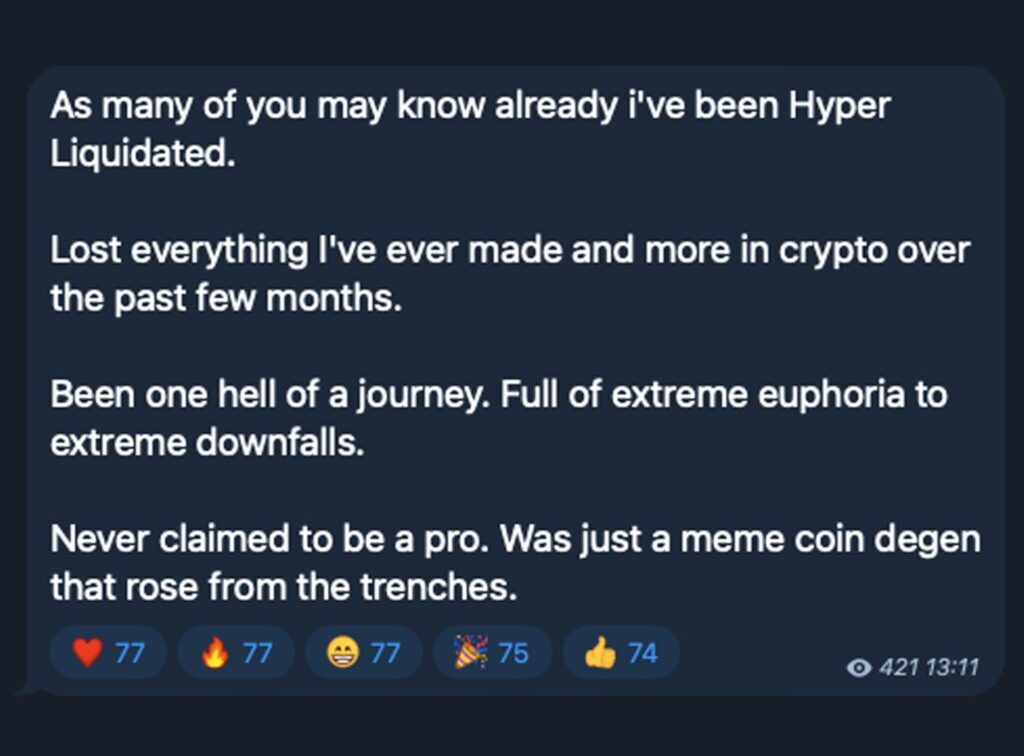

But the crypto gods are unforgiving. Just as fast as the rise came, Wynn’s empire crumbled. He started losing. Badly. His account began bleeding millions. That $87 million portfolio? Gone. The $1.2B long? Liquidated.

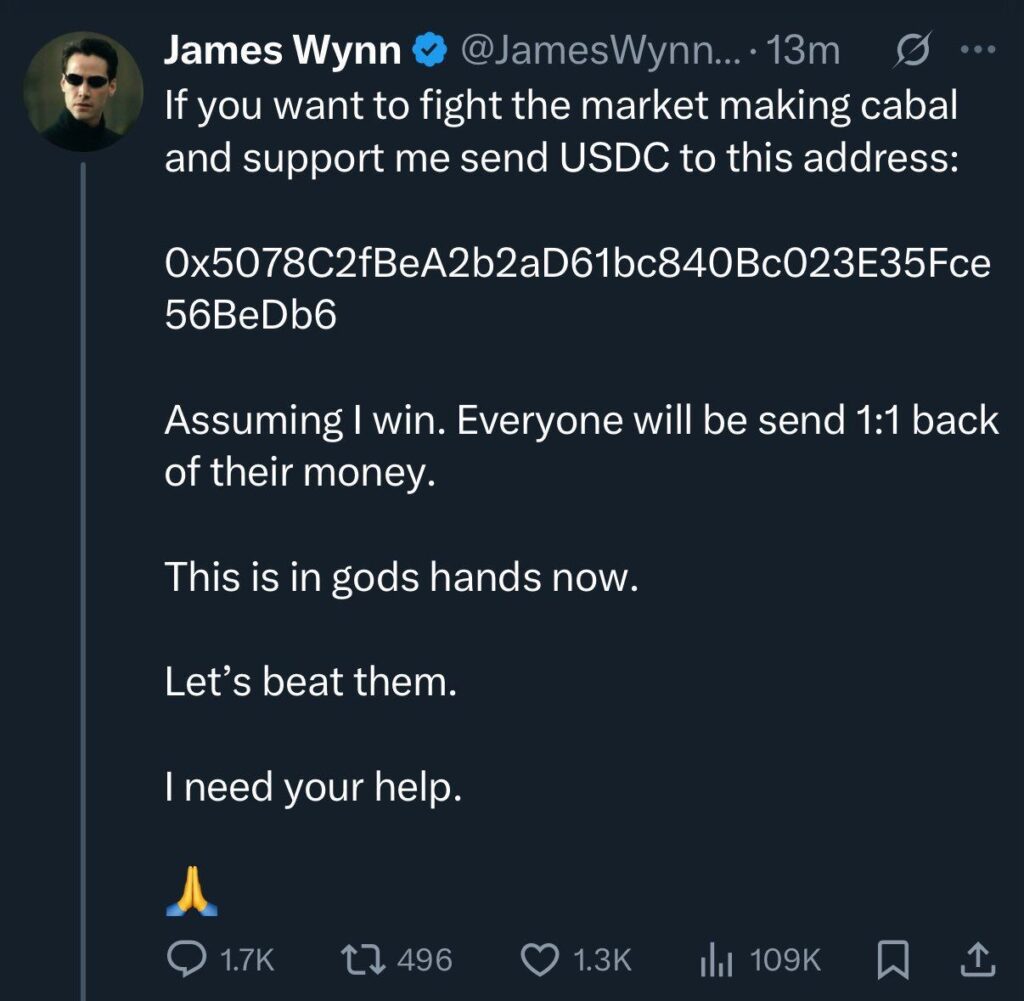

The very same feed that once shared screenshots of 8-figure wins now turned to donation requests. Rumors swirled that he had roundtripped nearly $100 million — bringing it all the way back down to zero.

And then — the final chapter — he deleted his X account. Vanished.

The community was left stunned. Was it real? Was it a performance? Was this all part of a broader marketing ploy by Hyperliquid to attract attention during its rise?

Theories and Speculation: Was It All a Marketing Ploy?

Some believe James Wynn was never a real person. That the entire saga was a masterstroke in viral marketing, a brilliant way to showcase HL’s capabilities — high liquidity, big trades, fast execution.

Others think he was a real trader who took massive risks, perhaps hedged off-platform, and simply reached too far. The donation posts might’ve been satire, or a final act in a play designed to stir the pot one last time.

And there are those who genuinely believe he was a degen savant — someone who stumbled upon generational alpha, only to fly too close to the sun.

Why It Matters

James Wynn’s story isn’t just gossip. It’s a case study in:

CT culture, where memes and reputation are currency.

The dangers of leverage, even in DeFi where positions can be bigger than entire hedge funds.

Speculative hysteria, where traders become influencers and influencers become myths.

Marketing in Web3, where the line between performance, identity, and virality is thin — and often deliberately blurred.

Love him or laugh at him, James Wynn’s saga is unforgettable. It encapsulates everything that makes crypto so chaotic, so addictive, and so absurdly entertaining.

A man who may have touched nine-figure wealth — and watched it all vanish in less than three months. A story equal parts tragedy, spectacle, and legend.

Whether James Wynn was real or not doesn’t even matter anymore. What matters is that he now lives forever in Crypto Twitter lore.