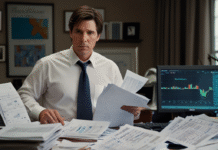

The S&P 500’s climb past 6,500 was not a fireworks display but a steady march, signaling that investors had already voted with conviction. Nvidia’s (NASDAQ: NVDA) recent dip was more of a pothole than a roadblock — unsettling for a moment, but not enough to change the direction of travel. The AI-driven rally remains on course, and traders continue to pay a premium for the belief that there’s still distance left to cover.

What was billed as a thunderclap of earnings from Nvidia turned out to be more like a heavy raindrop: briefly disruptive, quickly absorbed. The chipmaker’s guidance didn’t soar above expectations, but its footing held. At nearly 8% of the S&P, Nvidia is not a mere passenger in this rally — it’s the axle. And while China-related sales were left out of its outlook, the possibility of a policy breakthrough between Washington and Beijing keeps an unpriced upside in play.

U.S. Economy Still Rowing Strong

Beyond Nvidia, the broader economy continues to show resilience. Revised GDP for Q2 clocked in at 3.3%, with consumers still powering growth despite tariffs and trade frictions. Households remain the oarsmen of the U.S. economy, refusing to let go even as the waters grow choppier. Jobless claims also suggest employers are holding onto workers tightly, whether out of loyalty or fear of replacement costs.

But risks remain. Friday’s PCE inflation report is the next major test. A smooth print could keep the rally on track, while a hot number may scrape the hull. Market expectations are priced for volatility, though many believe the outcome will be absorbed without much disruption. Powell’s Jackson Hole comments still support hopes for rate cuts, even as sticky inflation keeps traders cautious.

Dollar Bends, Yuan Rises

In currencies, the dollar has finally shown some cracks. EUR/USD approached 1.1700, buoyed by stronger EU bond markets and upbeat German auto sales. Yet the bigger story is in Beijing, where authorities have been steadily guiding the yuan higher. This move is less about near-term stimulus and more about projecting China as a disciplined, reliable player in global finance.

A firmer renminbi helps household purchasing power, attracts foreign capital, and tugs other emerging-market currencies along with it. The rand, the real, and even the euro have felt its pull.

September’s Shadow

As markets approach September, history serves as a warning. The month has a reputation as the market’s cruelest stretch, often turning optimism into regret. Yet this year, the S&P enters with sails full — momentum above the 200-day moving average and expectations of rate cuts glimmering like a lighthouse on the horizon.

Crucially, this rally is broadening. While Nvidia remains the face of AI, sectors like financials, utilities, and healthcare are beginning to attract capital. The story is no longer about one stock; it’s becoming a fleet.

Outlook

For now, the market hums with forward motion. Volatility remains low, the AI theme remains intact, and the dollar’s grip is loosening as the renminbi takes on a more central role. The music of the markets hasn’t stopped — it has simply shifted into a steadier tempo. Traders can still dance, though September’s history reminds everyone to keep one hand on the wheel.