|

Getting your Trinity Audio player ready...

|

In the ever-evolving world of cryptocurrency, few stories are as intriguing — or extreme — as that of the Bitcoin Family. Known for selling all their possessions in 2017 to go “all in” on Bitcoin, they’ve now taken personal crypto security to an entirely new level.

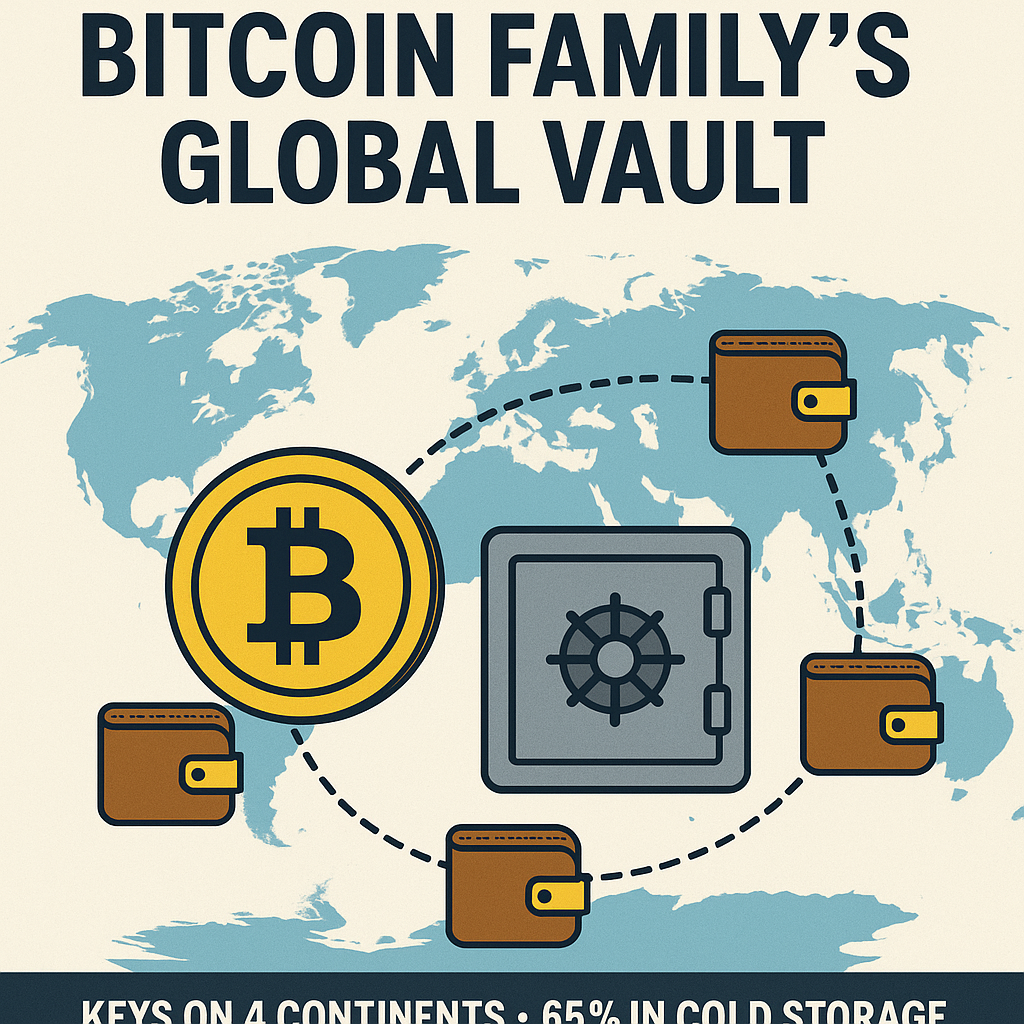

Today, 65% of their digital wealth is stored in cold wallets — offline crypto storage — spread across four continents. Yes, accessing their full portfolio requires intercontinental travel. That’s not just dedication; that’s a global security protocol.

To some, it may seem excessive. But in a time when online hacks, exchange failures, and geopolitical instability pose real threats to digital assets, their approach sends a clear message: security is sovereignty. For the Bitcoin Family, trust isn’t placed in banks, governments, or even centralized crypto platforms. It’s in their own hands — quite literally.

Their long-term vision? A staggering $1 million per Bitcoin by 2033. While that price target might sound like a moonshot, they are not alone in their belief that Bitcoin will continue to rise as fiat currencies weaken and global debt balloons.

Whether you see them as crypto evangelists or outliers, one thing is clear: the Bitcoin Family embodies a new era of digital wealth management — one defined by independence, resilience, and a borderless mindset.

At a time when many are still learning the basics of crypto, the Bitcoin Family is already writing the next chapter: self-custody on a global scale.

**mitolyn reviews**

Mitolyn is a carefully developed, plant-based formula created to help support metabolic efficiency and encourage healthy, lasting weight management.