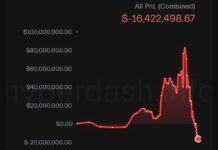

Another name has joined the growing list of firms humbled by the markets. AguilaTrades, a high-leverage trading outfit, has reportedly lost over $35 million in just two weeks.

What went wrong? The story is as old as trading itself.

They opened long positions early, then doubled down as the market rallied—without ever taking profits. When momentum slowed and volatility returned, they were caught overexposed and underprepared. The result: a swift and brutal liquidation.

🧠 What This Teaches Us

- This isn’t just a tale of loss. It’s a masterclass in what not to do

- Greed kills. The market rewards strategy, not emotion.

- Late entries on hype are risky by nature.

- Doubling down without stop-loss discipline is like fueling a fire you can’t control.

Taking profits isn’t weakness—it’s survival.

Aguila’s missteps echo a lesson many retail and institutional players often forget: leverage is a tool, not a parachute. Used recklessly, it becomes a ticking time bomb.

In crypto and leveraged markets, the difference between a bold strategy and a reckless gamble is often one decision away. Be smart. Be patient. Take profits when they’re on the table.

Because in this game, survival is the real alpha.